The future price of Bitcoin is a topic of much speculation and debate. While numerous factors could influence its price, accurately predicting its trajectory is impossible. This post will provide Bitcoin Monthly Technical Analysis for 2024. All our research done by crypto experts and our data will help you a lot regarding investment and understanding the future of Bitcoin for upcoming years.

Overview Bitcoin Monthly Technical Analysis 2024

- As of March 6, 2024, the price of Bitcoin is around $67,205.79.

- Bitcoin’s Fear and Greed Index is 75%(Greed)

- Investing in Bitcoin is ideal when the market value is at an all-time low and selling when it’s more than its average value.

- The all-time high value of Bitcoin was recorded at $69,044.77 on Nov 10, 2021.

- The all-time low value of Bitcoin was $67.81 on July 6, 2013.

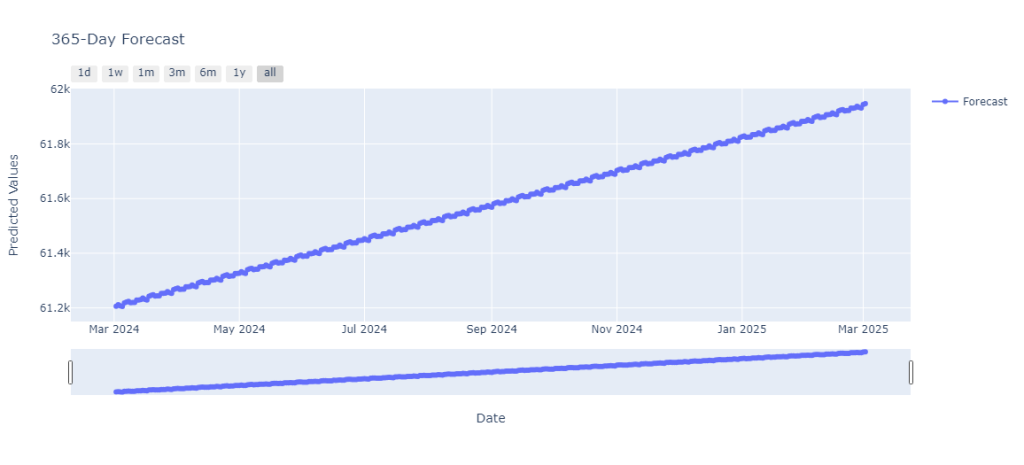

- Our prediction for Bitcoin (using the Exponential Smoothing Model) till the end of 2024 will be the maximum value of $62272.46845 and may drop to a minimum of $61205.01289.

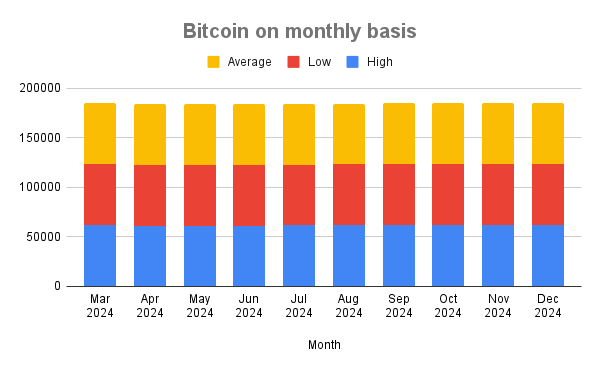

Forecast Bitcoin Monthly Technical Analysis Table for 2024

| Month | High | Low | Average |

| Mar 2024 | 62272.46845 | 61205.01289 | 61236.99239 |

| Apr 2024 | 61326.87458 | 61267.42694 | 61298.09023 |

| May 2024 | 61393.47268 | 61326.01712 | 61359.98232 |

| Jun 2024 | 61453.6263 | 61389.50045 | 61421.26764 |

| Jul 2024 | 61514.47691 | 61447.02136 | 61482.82716 |

| Aug 2024 | 61574.63053 | 61510.50469 | 61545.02941 |

| Sep 2024 | 61635.48115 | 61581.47219 | 61607.06138 |

| Oct 2024 | 61702.47642 | 61640.39686 | 61668.32292 |

| Nov 2024 | 61761.59638 | 61703.04218 | 61730.03628 |

| Dec 2024 | 61826.73568 | 61761.40109 | 61791.42842 |

What Changes Did Bitcoin Make This Time?

It’s important to clarify that Bitcoin, as the underlying technology, doesn’t inherently “make changes” in the traditional sense. However, its perceived value and ecosystem can evolve.

Here’s a summary of some recent developments related to Bitcoin:

- Price surge: In December 2023, Bitcoin reached a new all-time high, exceeding $41,000 [CBS News]. This surge is attributed to various factors, including increased institutional adoption and approval of the US’s first Bitcoin exchange-traded fund (ETF).

- Regulatory developments: Regulatory scrutiny of cryptocurrencies like Bitcoin continues to increase. In February 2024, the founder of a major crypto exchange faced charges, highlighting ongoing legal challenges in space.

It’s important to note that Bitcoin remains volatile, and its future trajectory is uncertain. While it has seen significant growth recently, potential risks and uncertainties associated with the technology and broader market conditions should also be considered.

Why Bitcoin in 2024?

There are several factors contributing to the increased interest and potential value of Bitcoin in 2024:

1. Recent price surge: As of March 6, 2024, Bitcoin has soared over 60% this year, reaching over $68,000 for the first time since 2021. This momentum fuels optimism and attracts new investors.

2. Increased accessibility and legitimacy: Approving the first Bitcoin ETF in the US in late 2023 is a significant step towards mainstream adoption. ETFs provide a regulated way for investors to gain exposure to Bitcoin without directly owning it, potentially increasing its accessibility and perceived legitimacy.

3. The upcoming halving: Scheduled for May 2024, the Bitcoin halving event is expected to impact its value further. This event cuts the reward for mining Bitcoin in half, historically leading to price increases due to decreased supply in the face of potential constant demand.

4. Growing institutional adoption: More and more financial institutions are exploring and investing in cryptocurrencies, including Bitcoin. This institutional involvement can bring more excellent stability and legitimacy to the market, potentially attracting further investment.

However, it’s crucial to remember that:

Bitcoin remains a highly volatile asset: Its price can fluctuate significantly, and past performance does not indicate future results.

The cryptocurrency market is still evolving and faces regulatory uncertainties, which can pose risks for investors.

What is the Use Cases of the Bitcoin?

Bitcoin’s first and most well-known cryptocurrency has evolved beyond its initial conception as a purely digital currency. Its use cases have grown and diversified while it still functions in that capacity. Here’s a breakdown of some prominent applications of Bitcoin:

1. Store of value: Like gold, some individuals view Bitcoin as a hedge against inflation and a way to store wealth over the long term. Its limited supply (capped at 21 million coins) and decentralized nature contribute to this perception.

2. Cross-border transactions: Bitcoin facilitates faster and potentially cheaper international payments than traditional banking systems. Transactions occur directly between individuals or entities without intermediaries, potentially reducing fees and processing times.

3. Remittances: Migrant workers can send money back home using Bitcoin, potentially avoiding high fees and slow processing times associated with traditional money transfer services.

4. Access to financial services: In regions with limited access to traditional banking systems, Bitcoin can offer an alternative way for individuals to store and transfer value. This can be particularly relevant for the “unbanked” population who lack access to traditional bank accounts.

5. Investment: Some view Bitcoin as a high-risk, high-reward investment opportunity. Its price fluctuations can be significant, and investors should know the associated risks before making investment decisions.

6. Emerging use cases: Beyond these established applications, there are ongoing explorations into using Bitcoin for:

- Micropayments: Facilitating payments for small amounts of goods or services online.

- Decentralized finance (DeFi): Participating in a new financial ecosystem built on blockchain technology, enabling activities like lending and borrowing without relying on traditional financial institutions.

Bitcoin Monthly Technical Analysis for 2024

We predict the maximum value of the Bitcoin (using the Exponential Smoothing Model) in 2024 may achieve the maximum value of $62272.46845, and the lower value may reach around $61205.01289. The average trading value of Bitcoin will stay around $61112.01334. Our monthly technical analysis for Bitcoin 2024 is given below. It will help you understand this coin’s value in terms of future investment.

Bitcoin Monthly Technical Analysis for March

Our research team predicts the highest value of Bitcoin in March 2024 will be around $62272.46845, which may go down to $61205.01289. The average trading value will be $61236.99239.

Bitcoin Monthly Technical Analysis for April

We assume the highest value of the Bitcoin in April 2024 to be around $61326.87458, which may be down to $61267.42694. The average trading value will be $61298.09023.

Bitcoin Monthly Technical Analysis for May

Our crypto market research team predicts the value of the Bitcoin token in May 2024 will reach the maximum value of $61393.47268, and the lower value may be around $61326.87458. The average value will touch $61359.98232.

Bitcoin Monthly Technical Analysis for June

We expect the Bitcoin token to reach its highest value of $61453.6263 in June. It may touch the lower value of $61389.50045. The average value will stay around $61421.26764.

Bitcoin Monthly Technical Analysis for July

According to our research team, the Bitcoin token will reach the highest value of $61514.47691 and the lowest value of $61447.02136 in July. The average value will be around $61482.8282716.

Bitcoin Monthly Technical Analysis for August

The prediction of the Bitcoin for August 2024 will be the highest value of $61574.63053, which may touch down to $61510.50469. The average value will be around $61545.02941.

Bitcoin Monthly Technical Analysis for September

We predict the Bitcoin value will reach the maximum of $61635.48115 and may go down to $261581.47219 in September 2024. The average value will be $61607.06138.

Bitcoin Monthly Technical Analysis for October

For October 2024, our prediction for Bitcoin’s peak value will be around $61702.47642, which may be down to $61640.39686. The average value will be around $61668.32292.

Bitcoin Monthly Technical Analysis for November

The maximum value of the Bitcoin for November 2024 will be around $61761.59638, which may be down to $61703.04218. The average value will be around $61730.03628.

Bitcoin Monthly Technical Analysis for December

Our research team predicts that Bitcoin may reach a maximum value of $61826.73568 and be down to $61761.40109 by December 2024. The average trading value will be $61791.42842.

Methodology

- The historical Bitcoin dataset starting from April 28, 2013, to February 29, 2024, has been systematically imported from CoinGecKo Platforform.

- Employing Exponential Smoothing methodology, Bitcoin price forecasting has been executed with a horizon extended up to the year 2024.

- Leveraging the advantages of Exponential Smoothing, particularly suited for short-term forecasting, the model adeptly focuses on recent data, enhancing precision in trend analysis.

- Forecasting periods were set at 365 days for one-year projection, ensuring comprehensive coverage.

- Post-execution of these procedural steps, outcomes have been methodically categorized into monthly segments, discerning High, Low, and Average values.

- Visualization techniques , such as graphical representations have been applied to the results, facilitating a comprehensive understanding and streamlined trend identification for the forthcoming year.

FAQs on Bitcoin Monthly Technical Analysis

In this section, we have discussed some of the frequently asked questions that might be helpful for you, so don’t skip them.

Q. What factors could affect Bitcoin’s price in the coming years (2024-2030)?

Several facts can affect the price of Bitcoin in the next 5 to 6 years, like

- Regulation

- Overall economic condition

- Institutional Adoption

- Upcoming events

- Technology and advancements

Q. What resources can help me learn more about Bitcoin and cryptocurrency?

Several resources can help you learn more about Bitcoin and the broader cryptocurrency space:

Educational websites: Look for websites like Coinmarketcap, Investopedia, or Khan Academy for introductory and educational content.

Financial news outlets: Stay informed about industry news and developments through reputable financial news sources that cover cryptocurrencies.

Books and podcasts: Numerous books and podcasts delve deeper into Bitcoin, blockchain technology, and cryptocurrency.

Q. Is Bitcoin legal in my country?

The legality and regulatory landscape surrounding cryptocurrencies vary by country. Researching and understanding the relevant regulations in your jurisdiction is crucial before investing in Bitcoin or any other cryptocurrency.

Conclusion

If you are still following the post, you must have an overall idea of how Bitcoin works and its use cases. Though it’s impossible to predict the exact future of this coin, the current trend says this is a high-potential crypto with huge potential to disrupt the crypto market on a large scale. So, what’s the thought? Do share it with us. Thanks.