The future price of Bitcoin is a topic of much speculation and debate. While numerous factors could influence its price, accurately predicting its trajectory is impossible. This post will provide Bitcoin Yearly Technical Analysis 2025, and 2030. All our research done by crypto experts and our data will help you a lot regarding investment and understanding the future of Bitcoin for upcoming years.

Overview Bitcoin Yearly Technical Analysis 2025 to 2030

- As of March 6, 2024, the price of Bitcoin is around $67,205.79.

- Bitcoin’s Fear and Greed Index is 75%(Greed)

- Investing in Bitcoin is ideal when the market value is at an all-time low and selling when it’s more than its average value.

- The all-time high value of Bitcoin was recorded at $69,044.77 on Nov 10, 2021.

- The all-time low value of Bitcoin was $67.81 on July 6, 2013.

- Our prediction for Bitcoin (using the Exponential Smoothing Model) till the end of 2024 will be the maximum value of $62272.46845 and may drop to a minimum of $61205.01289.

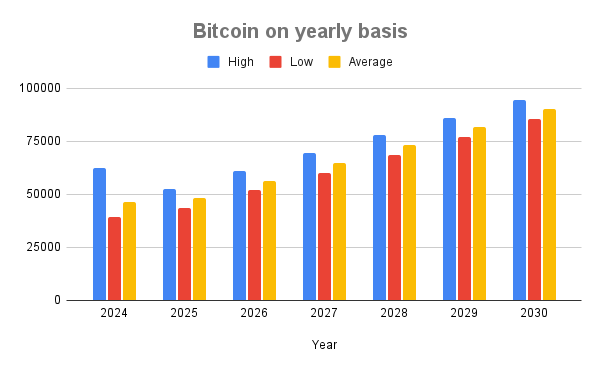

Forecast Bitcoin Yearly Technical Analysis Table Of 2024-2030

| Year | High | Low | Average |

| 2024 | 62504.78906 | 39507.36719 | 46281.46732 |

| 2025 | 52593.24784 | 43658.44511 | 48114.48465 |

| 2026 | 61017.67612 | 51959.63414 | 56501.24108 |

| 2027 | 69433.87316 | 60292.64876 | 64888.08641 |

| 2028 | 77835.52045 | 68665.70435 | 73285.2693 |

| 2029 | 86219.72865 | 77178.17063 | 81684.91918 |

| 2030 | 94583.96564 | 85542.64764 | 90071.84901 |

What is the Future of Bitcoin?

Predicting the future of Bitcoin, or any other asset, is inherently uncertain. However, based on current trends and expert opinions, here’s a glimpse into what the future of Bitcoin might hold:

Potential Growth

- Continued adoption: Increased institutional investment, wider acceptance by merchants, and potential regulatory clarity could lead to broader adoption and mainstream use of Bitcoin.

- Impact of halving: The upcoming May 2024 halving event could lead to price appreciation due to a decrease in supply, like past halving events.

- Technological advancements: Advancements in blockchain technology and the development of new use cases for Bitcoin could unlock its potential beyond just a store of value.

Possible Challenges

- Volatility: Bitcoin’s price is still prone to significant fluctuations, posing risks for investors.

- Regulatory landscape: Evolving regulations and potential government restrictions could hinder Bitcoin’s growth and adoption.

- Environmental concerns: The energy consumption associated with Bitcoin mining remains significant, impacting its public image and potentially leading to stricter regulations.

It’s important to remember that these are just potential scenarios, and the future of Bitcoin ultimately depends on various complex and interconnected factors.

What is the Use Cases of Bitcoin?

Bitcoin’s first and most well-known cryptocurrency has evolved beyond its initial conception as a purely digital currency. Its use cases have grown and diversified while it still functions in that capacity. Here’s a breakdown of some prominent applications of Bitcoin:

1. Store of value: Like gold, some individuals view Bitcoin as a hedge against inflation and a way to store wealth over the long term. Its limited supply (capped at 21 million coins) and decentralized nature contribute to this perception.

2. Access to financial services: In regions with limited access to traditional banking systems, Bitcoin can offer an alternative way for individuals to store and transfer value. This can be particularly relevant for the “unbanked” population who lack access to traditional bank accounts.

3. Investment: Some view Bitcoin as a high-risk, high-reward investment opportunity. Its price fluctuations can be significant, and investors should know the associated risks before making investment decisions.

Bitcoin Yearly Technical Analysis 2025-2030

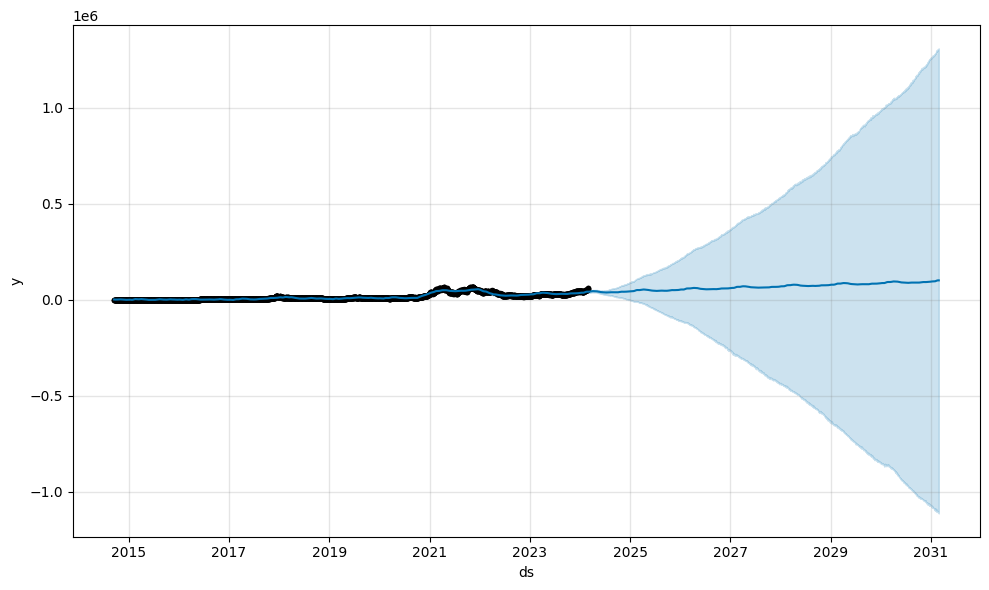

In this part of the post, we will provide market research and analytical data on Bitcoin Yearly Technical Analysis from 2025 to 2030. This data is based on the Prophet Model and will help investors look for future data for long-term investment.

Bitcoin Yearly Technical Analysis 2025

As per our crypto market analysis, the peak value of Bitcoin in 2025 will be around $52593.24784, which may reach a lower value of $43658.44511. The average trading value will be $48114.48465.

Bitcoin Yearly Technical Analysis 2026

Our prediction of the Bitcoin crypto token 2026 might surprise you. This year, Bitcoin may reach the highest value of $61017.67612, and the lower value may be around $51959.63414. The average trading value will be around $56501.24108.

Bitcoin Yearly Technical Analysis 2027

Our prediction on the Bitcoin token price in 2027 might be unexpected. This year, the Bitcoin coin may touch the highest value of $69433.87316, and the lower value may be around $60292.64876. The average trading value will be around $29.044628.

Bitcoin Yearly Technical Analysis 2028

We predict the Bitcoin may reach the maximum value of $77835.52045 and the lowest value of $68665.70435 in the 2028 calendar year. The average value will be around $73285.2693.

Bitcoin Yearly Technical Analysis 2029

Our market analysis data expects that the highest value of Bitcoin may reach $86219.72865, and it may touch the lowest value of $77178.17063 in 2029. The average trading value of this coin will be around $81684.91918.

Bitcoin Yearly Technical Analysis 2030

Our crypto analytic team predicts that the maximum Bitcoin price will be around $94583.96564, and the lower value may be around $85542.64764 in 2030. The average value will be about $90071.84901.

Methodology

- Utilizing the consistent Bitcoin dataset, we conducted price forecasting across diverse temporal scopes.

- The forecasting of Bitcoin prices until 2030 has been executed employing the Prophet Model, renowned for its proficiency in accommodating long-term dynamics.

- Prophet, an advanced forecasting model engineered by Facebook, demonstrates exceptional efficacy in long-term predictions, seamlessly integrating seasonality, holidays, and events to ensure precision and user-friendly forecasting.

- Forecasting periods were set at 2190 days for six-year projections, ensuring comprehensive coverage.

- Following the completion of these analytical processes, the yearly outcomes have been meticulously stratified into distinct classifications of High, Low, and Average values.

- The outcome of the analytical procedures has been transcribed into visual graphics, offering an enhanced medium for trend identification spanning upcoming years.

FAQs On Bitcoin Technical Analysis

In this section, we have discussed some of the frequently asked questions that might be helpful for you, so don’t skip them.

Q. What factors could affect Bitcoin’s price in the coming years (2024-2030)?

Several facts can affect the price of Bitcoin in the next 5 to 6 years, like

- Regulation

- Overall economic condition

- Institutional Adoption

- Upcoming events

- Technology and advancements

Q. What resources can help me learn more about Bitcoin and cryptocurrency?

Several resources can help you learn more about Bitcoin and the broader cryptocurrency space:

Educational websites: Look for websites like Coinmarketcap, Investopedia, or Khan Academy for introductory and educational content.

Financial news outlets: Stay informed about industry news and developments through reputable financial news sources that cover cryptocurrencies.

Books and podcasts: Numerous books and podcasts delve deeper into Bitcoin, blockchain technology, and cryptocurrency.

Q. Is Bitcoin legal in my country?

The legality and regulatory landscape surrounding cryptocurrencies vary by country. Researching and understanding the relevant regulations in your jurisdiction is crucial before investing in Bitcoin or any other cryptocurrency.

Conclusion

If you are still following the post, you must have an overall idea of how Bitcoin works and its use cases. Though it’s impossible to predict the exact future of this coin, the current trend says this is a high-potential crypto with huge potential to disrupt the crypto market on a large scale. So, what’s the thought? Do share it with us. Thanks.