Binance Coin (BNB) has an impressive position as a dominant crypto player. This post will provide you with the BNB Yearly Technical Analysis 2025-2030. Here, our experts followed the market trend and predicted the value according to technical analysis, which helps investors understand this coin. In this post, you will learn how this coin works and the associated technical advancements. So, let’s know more details about all these things.

Overview BNB Yearly Technical Analysis 2025-2030

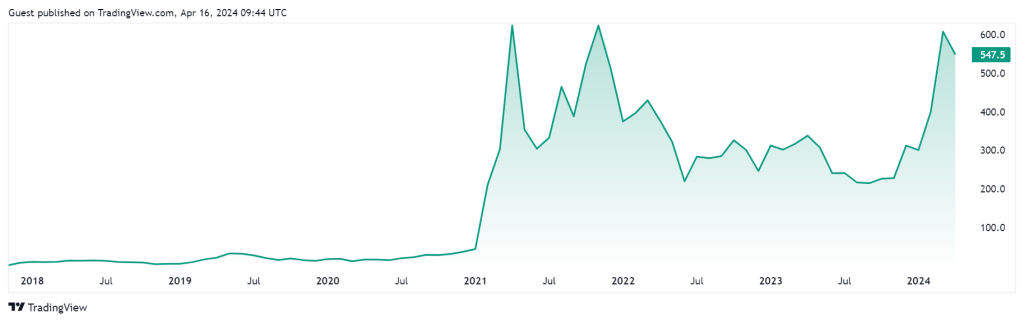

- As of April 22, 2024, the current price of BNB Crypto token is $604. 29.

- BNB ’s Fear and Greed Index is 61% (Greed).

- Investing in a BNB is ideal when the market has been fearful for a long time and selling when the value is at its peak.

- The all-time high value of the BNB was recorded at $686.31 on May 10, 2021.

- The all-time low value of BNB was $0.03982. on Oct 19, 2017.

- Our prediction for the BNB Coin (using the Exponential Smoothing model) till the end of 2024 will be the maximum value of $647.777355 and may drop to a minimum of $566.402133.

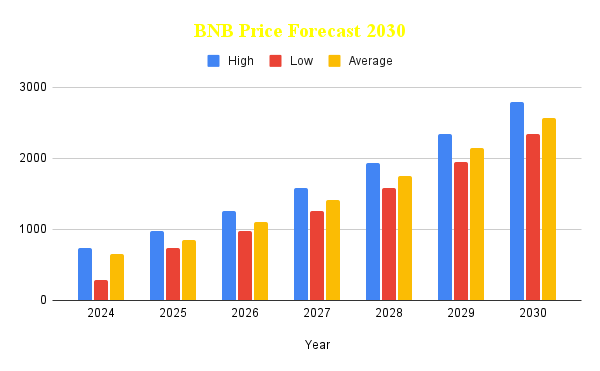

Forecast BNB Yearly Table Of 2024-2030

| Year | High | Low | Average |

| 2024 | 731.281763 | 291.919281 | 656.176139 |

| 2025 | 972.68428 | 731.828658 | 848.93596 |

| 2026 | 1254.715081 | 973.455997 | 1110.710558 |

| 2027 | 1577.164422 | 1255.493132 | 1413.003896 |

| 2028 | 1941.233012 | 1578.149759 | 1756.323128 |

| 2029 | 2344.920278 | 1942.325953 | 2140.253932 |

| 2030 | 2789.048406 | 2346.042807 | 2564.215393 |

What is the Future of BNB?

Guessing the future of any cryptocurrency is fundamentally ambitious, but here’s a look at some possibilities for Binance Coin (BNB):

Positive Outlook

- Dominant Exchange: If Binance maintains its position as a leading cryptocurrency exchange, BNB could benefit from an increased user base and trading activity, potentially driving up demand for the token.

- Expanding Ecosystem: Continued growth of the Binance ecosystem, including DeFi applications, NFT platforms, and Launchpad projects built on BNB Chain and BSC, could significantly increase BNB’s utility and value.

- Wider Adoption as Utility Token: If BNB gains wider adoption for various purposes beyond the Binance ecosystem, such as transaction fees on other platforms or in-game currencies, its overall usability and demand will increase.

- Successful Regulatory Navigation: If Binance successfully navigates the evolving regulatory landscape and expands globally, BNB could benefit from its association with a well-established exchange.

Negative Outlook

- Regulatory Crackdown: Increased regulatory scrutiny or restrictions on cryptocurrency exchanges could hinder Binance’s operations and negatively impact BNB’s price.

- Competition: Competition from other cryptocurrency exchanges with their tokens could limit BNB’s market share and user base.

- Technological Advancements: The emergence of new blockchain technologies or alternative solutions could render BNB or the Binance ecosystem obsolete.

What is the Use Cases of the BNB ?

BNB offers a variety of use cases that extend beyond simply being the native token of the Binance cryptocurrency exchange. Here’s a breakdown of some of its key functionalities:

Trading Fees and Discounts

- BNB is the primary token for paying transaction fees on the Binance exchange. Users can enjoy significant discounts on trading fees by holding and using BNB.

- These discounts incentivize users to hold BNB, potentially increasing demand for the token.

Launchpad and NFT Platform Participation

- BNB is often required to participate in token sales and Initial Exchange Offerings (IEOs) hosted on the Binance Launchpad.

- The Binance NFT platform also frequently uses BNB to purchase and trade NFTs (non-fungible tokens).

- These functionalities create additional demand for BNB as users need it to participate in these offerings.

Travel Booking and Entertainment

- While still in its early stages, BNB can be used to book travel arrangements and pay for various services on select platforms.

- This demonstrates the potential for broader adoption of BNB as a general utility token beyond the cryptocurrency exchange sphere.

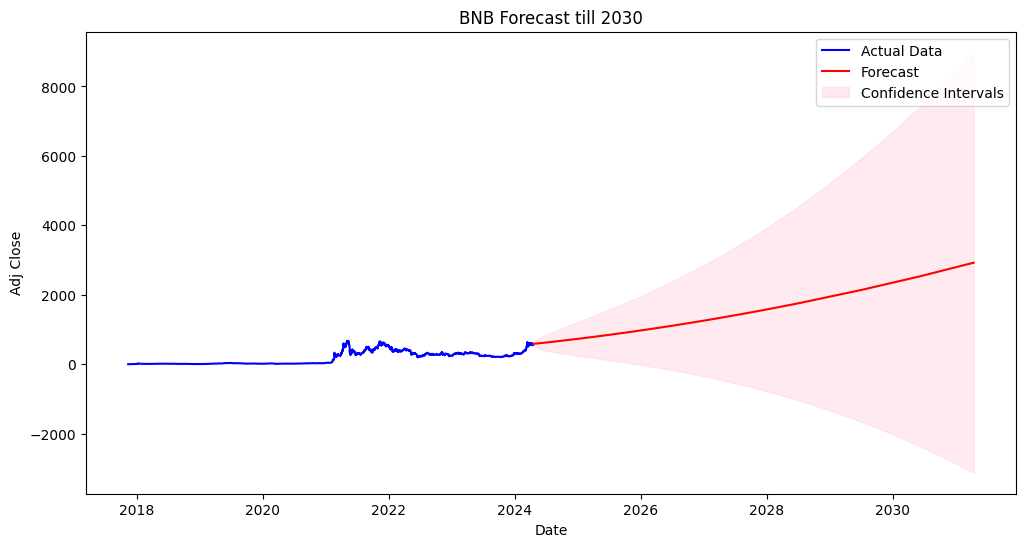

BNB Yearly Technical Analysis From 2025-2030

In this part of the post, we will provide the BNB Crypto Technical Analysis from 2025 to 2030 using the SARIMA-X model. This data will help you with future BNB Crypto coin investments. Let’s know more about the predicted value of this coin for the next few years.

BNB Yearly Technical Analysis 2025

As per our crypto market analysis, the peak value of BNB Crypto in 2025 will be around $731.281763, which may reach a lower value of $ 291.919281. The average trading value will be $ 656.176139.

BNB Yearly Technical Analysis 2026

The BNB Crypto token in 2026 may touch the highest value of $ 1254.715081, and the lower value may be around $973.455997. The average trading value will be around $ 1110.710558.

BNB Yearly Technical Analysis 2027

Our prediction on the BNB Crypto token price in 2027 might surprise investors. This year, the BNB Crypto coin may touch the highest value of $ 1577.164422, and the lower value may be around $1255.493132. The average trading value will be around $ 1413.003896.

BNB Yearly Technical Analysis 2028

We predict the BNB Crypto coin may reach the maximum value of $ 1941.233012 and the lowest value of $ 1578.149759 in the 2028 calendar year. The average value will be around $ 1756.323128.

BNB Yearly Technical Analysis 2029

Our market analysis data expects that the highest value of the BNB Crypto coin may reach $ 2344.920278, and it may touch the lowest value of $ 1942.325953 in 2029. The average trading value of this coin will be around $ 2140.253932.

BNB Yearly Technical Analysis 2030

Our crypto analyst team predicts that the maximum BNB token price will be around $2789.048406, and the lower value may be approximately $ 2346.042807 in 2030. The average value will be about $ 2564.215393.

Methodology

- Using consistent BNB Crypto Prices, our study predicted prices across various timeframes.

- Using differencing operations, SARIMA-X models address non-stationary data, ensuring the long-term forecast’s reliability despite trends or drift.

- The model’s proficiency in forecasting is evident with an MAE of 1.51, reflecting its consistent accuracy in predicting values close to the observed ones.

- With the forecasting periods set at 2190 days, comprehensive coverage was ensured for the six-year projections.

- After completing analytical processes, yearly outcomes were meticulously classified into High, Low, and Average values, and visual representations were generated using Machine Learning algorithms to detect future trends, facilitating forecasting.

FAQs On BNB Yearly Technical Analysis

Here, we have discussed some of the frequently asked questions that might be important for you. So don’t skip this part.

Q. What is the purpose of BNB?

BNB serves multiple purposes. It fuels the Binance exchange with discounts on trading fees, acts as the native coin for Binance Smart Chain (BSC) for transactions, and unlocks features like staking and participation in project launches. BNB is the key that opens various doors within the Binance ecosystem.

Q. When did BNB first launch?

Binance Coin (BNB) was launched in July 2017 via an Initial Coin Offering (ICO). BNB tokens were initially sold to the public to raise funds for the Binance platform’s development.

Q. What is the total supply of BNB?

The total supply of BNB tokens is 153.9M out of a total supply of 153.9M.

Conclusion

If you are still following this post, you must have an overall idea about BNB crypto, its work, and its upcoming projects. Our analysis says this is a perfect coin for future investment. Undoubtedly, this is a high-potential coin with a strong community, which might be a future game changer in the crypto industry.