Can Ethereum Classic (ETC) maintain its momentum in 2024 and beyond? This article explores potential future price trajectories for ETC, examining technical indicators, market trends, and expert analysis. We will provide Ethereum Classic Monthly Technical Analysis For 2024, which will clarify the future of this unique Proof-of-Work blockchain project. So, let’s get into the details to understand the potential of this trendy coin.

Overview Ethereum Classic Monthly Technical Analysis 2024

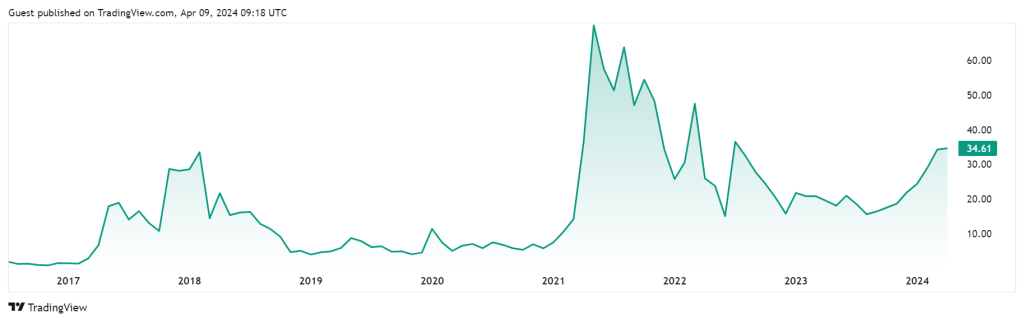

- As of April 10, 2024, the current price of the Ethereum Classic token is $32.86.

- Ethereum Classic’s Fear and Greed Index is 80% (Extreme Greed).

- Investing in Ethereum Classic is ideal when the market has been fearful for a long time and selling when the value is at its peak.

- The all-time high value of the Ethereum Classic was recorded at $167.09 on May 06, 2021.

- The all-time low value of Ethereum Classic crypto was $0.615. on Jul 25, 2016.

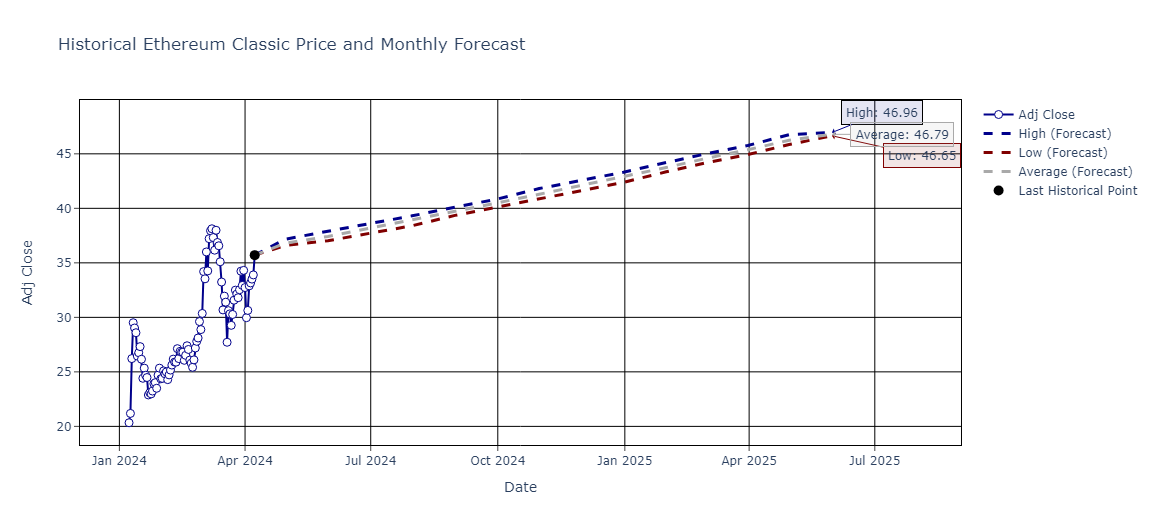

- Our prediction for the Ethereum Classic (using the SARIMA-X model) till the end of 2024 will be the maximum value of $ 43.313722 and may drop to a minimum value of $ 42.382585.

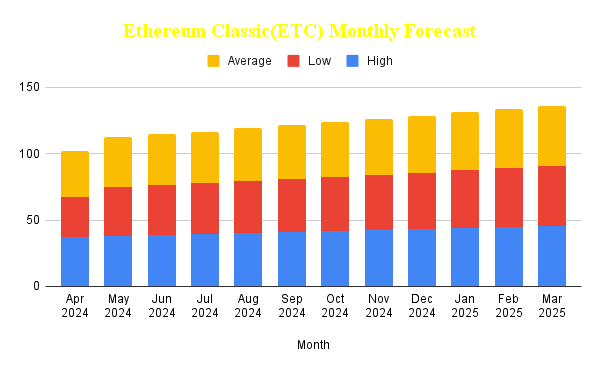

Forecast Ethereum Classic (ETC) Monthly Technical Analysis Table for 2024

| Month | High | Low | Average |

| Apr 2024 | 37.167382 | 29.970011 | 34.88984 |

| May 2024 | 37.897754 | 37.025557 | 37.421275 |

| Jun 2024 | 38.588944 | 37.708928 | 38.160186 |

| Jul 2024 | 39.312485 | 38.401784 | 38.914734 |

| Aug 2024 | 40.109767 | 39.353453 | 39.707602 |

| Sep 2024 | 40.831917 | 40.083926 | 40.484846 |

| Oct 2024 | 41.816751 | 40.901462 | 41.291668 |

| Nov 2024 | 42.560423 | 41.637214 | 42.083132 |

| Dec 2024 | 43.313722 | 42.382585 | 42.894874 |

| Jan 2025 | 44.201142 | 43.349118 | 43.747628 |

| Feb 2025 | 44.976381 | 44.160135 | 44.555954 |

| Mar 2025 | 45.761259 | 44.935815 | 45.375244 |

What Changes Ethereum Classic May Make this Time?

Here are some potential areas where Ethereum Classic (ETC) might evolve.

- Addressing Scalability: Ethereum Classic currently faces some scalability limitations, meaning it can struggle to handle a high volume of transactions. Future changes involve implementing solutions like sharding or layer-2 protocols to increase network capacity.

- Interoperability with Ethereum (ETH): While maintaining its identity, ETC might explore ways to improve interoperability with the Ethereum network. This could allow developers to build applications that leverage the strengths of both platforms.

- Focus on Security and Decentralization: Given its commitment to Proof-of-Work (PoW), Ethereum Classic might see advancements in mining algorithms or security protocols to avoid potential threats.

- Evolving Governance: The Ethereum Classic community might explore refining its governance model to ensure efficient decision-making and project development.

- Versioning for Smart Contracts: This potential change would allow for backward compatibility while enabling the introduction of new functionalities without affecting existing applications on the network.

Why Ethereum Classic in 2024?

There are a few reasons why someone might be interested in Ethereum Classic (ETC) in 2024

- Potential for Price Increase: Several predictions forecast a rise in ETC value throughout 2024, with some reaching as high as $87.40 by October. It’s important to remember that these are predictions, not guarantees, and the volatile cryptocurrency market.

- Proof-of-Work (PoW) vs. Proof-of-Stake (PoS): Ethereum Classic remains committed to the PoW consensus mechanism, unlike Ethereum (ETH), which transitioned to PoS. Some investors believe PoW offers greater security and decentralization, making ETC an attractive alternative.

- Community and Development: The Ethereum Classic community is active and continues to develop the project. There’s recent news on their website about educational initiatives and community events.

- Market Sentiment: Currently, the market sentiment surrounding ETC appears bullish, with a Fear and Greed Index score in the “Extreme Greed” zone. This could indicate a potential correction.

- Overall Crypto Market: The success of ETC is also tied to the overall health of the cryptocurrency market.

What is the Future of Ethereum Classic?

The future of Ethereum Classic (ETC) is still being determined, with both potential for growth and challenges to overcome. Here’s a breakdown of some key factors to consider.

Possible Growth Factors

- Continued Ethereum (ETH) dominance: If Ethereum (ETH) maintains its leading position in smart contracts, it could bring more attention and use cases to ETC as a secure alternative with a similar codebase.

- Proof-of-Work (PoW) preference: If concerns arise over the environmental impact or centralization of Proof-of-Stake (PoS) used by ETH, ETC’s commitment to PoW could attract miners and users who value those aspects.

- Community Development: A strong and active developer community can create innovative applications and functionalities for ETC, boosting its utility and value.

Challenges to Consider

- Competition: Many other innovative contract platforms are vying for market share, ETC needs to find ways to differentiate itself.

- Limited Adoption: ETC has a smaller user base and ecosystem than ETH, making it less attractive for developers and businesses to build on.

- Market Volatility: The cryptocurrency market is inherently volatile; ETC’s price can fluctuate significantly.

The Use Cases of the Ethereum Classic

Ethereum Classic (ETC) offers several use cases, some of which are mentioned below.

Immutable Record-Keeping

- Ethereum Classic offers a secure and tamper-proof way to store that, like other blockchains. This could be used for things like tracking ownership of assets, recording votes, or storing medical records.

Potential Store of Value

- Some investors view ETC as a potential store of value, like gold or Bitcoin. Its limited supply and potential for future adoption could make it an asset over time.

Ethereum Classic Monthly Technical Analysis for 2024

Our expert analysis indicates the maximum Ethereum Classic Crypto Monthly Technical Analysis (using the SARIMA-X Model) in 2024 may reach around $ 43.313722, and the lower value will be around $29.970011. The average trading value of Graph will be approximately $35.26789.

Ethereum Classic Monthly Technical Analysis for April

We assume the highest value of the Ethereum Classic coin in April 2024 to be around $37.167382, which may be down to $29.970011. The average trading value will be $34.88984.

Ethereum Classic Monthly Technical Analysis for May

Our crypto market research team predicts the value of the Ethereum Classic token in May 2024 will reach the maximum value of $37.897754, and the lower value may be around $37.025557. The average value will touch $37.421275.

Ethereum Classic Monthly Technical Analysis for June

We expect the Ethereum Classic coin token to reach its highest value of $38.588944 in June. It may touch the lower value of $37.708928. The average value will stay around $38.160186.

Ethereum Classic Monthly Technical Analysis for July

According to our research team, the Ethereum Classic token will reach the highest value of $39.312485 and the lowest value of $38.401784 in July. The average value will be around $38.914734.

Ethereum Classic Monthly Technical Analysis for August

The Ethereum Classic monthly technical analysis for August 2024 will be the highest value of $40.109767, which may touch down to $39.353453. The average value will be around $39.707602.

Ethereum Classic Monthly Technical Analysis for September

We predict the ETC price will reach the maximum of $40.831917 and may go down to $40.083926 in September 2024. The average value will be $40.484846.

Ethereum Classic Monthly Technical Analysis for October

For October 2024, our prediction for the Ethereum Classic Price will be a maximum of around $41.816751, which may be down to $40.901462. The average value will be approximately $41.291668.

Ethereum Classic Monthly Technical Analysis for November

The maximum value of the Ethereum Classic coin for November 2024 will be around $42.560423, which may be down to $41.637214. The average value will be around $42.083132.

Ethereum Classic Monthly Technical Analysis for December

Our research team predicts that the Ethereum Classic coin may reach a maximum value of $43.313722 and be down to $42.382585 by December 2024. The average trading value will be $42.894874.

Methodology

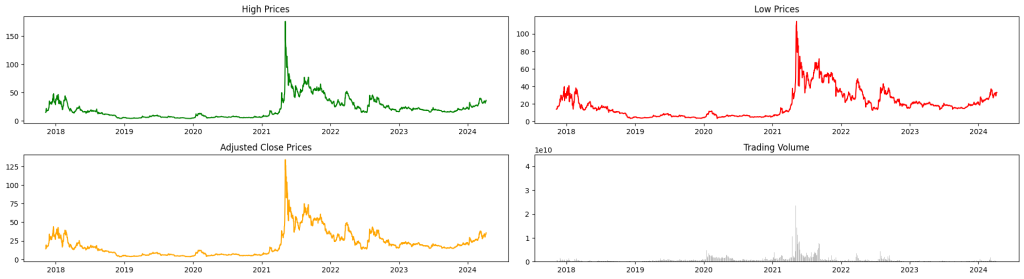

- The historical Ethereum Classic Crypto prices from November 09, 1999, to April 08, 2024, have been systematically imported from the Yahoo finance Platform.

- The p-value of 0.08 from the Augmented Dickey-Fuller (ADF) test on ETC historical prices suggests weak evidence against the null hypothesis of stationarity.

- In simpler terms, it indicates that the data may be stationary.

- Given that the data may be stationary according to the ADF test results, SARIMA-X remains a potential choice for forecasting.

- SARIMA-X models can handle stationary and non-stationary data by incorporating different operations to transform the data into a suitable form for modeling and forecasting purposes.

- A lower MAE of 0.47 underscores the model’s proficiency in forecasting, as it demonstrates a consistent trend of making predictions that are, on average, very close to the observed values.

- Forecasting periods were set at 366 days for One-year projections, ensuring comprehensive coverage.

- Post-execution of these procedural steps, outcomes have been methodically categorized into monthly segments, discerning High, Low, and Average values.

- Through impactful visualizations, we’ve made it easy for investors to grasp forecasted trends effortlessly for the upcoming year.

FAQs On Ethereum Classic Monthly Technical Analysis

Here, we will discuss some crucial questions that might greatly help you. So don’t skip this section.

Q. What is Ethereum Classic used for?

Ethereum Classic (ETC) is a blockchain platform like Ethereum but focuses on staying true to the original code. It’s used for running decentralized applications (dApps), making payments, storing data securely, and potentially as a long-term investment.

Q. What is the difference between Ethereum Classic and Ethereum?

Ethereum Classic (ETC) and Ethereum (ETH) are similar blockchains, but with a key difference. ETC stuck to the original Ethereum code, while ETH changed it for security reasons.

Q. Is Ethereum Classic layer 1?

Yes, Ethereum Classic (ETC) is a layer one blockchain. Layer 1 blockchains are the foundational networks that process transactions and maintain the ledger’s state. They are the core infrastructure upon which other applications and protocols can be built.

Conclusion

This post is all about the Ethereum classic future value prediction, upcoming projects, and potential investment properties considering the use cases. We have provided all the data that indicates the potential of this coin, and our prediction data helps investors regarding future investments.