Can Ethereum Classic (ETC) maintain its momentum in 2024 and beyond? This article explores potential future price trajectories for ETC, examining technical indicators, market trends, and expert analysis. We will provide Ethereum Classic Yearly Technical Analysis For 2025-2030, which will clarify the future of this unique Proof-of-Work blockchain project. So, let’s get into the details to understand the potential of this trendy coin.

Overview Ethereum Classic Yearly Technical Analysis 2024 to 2030

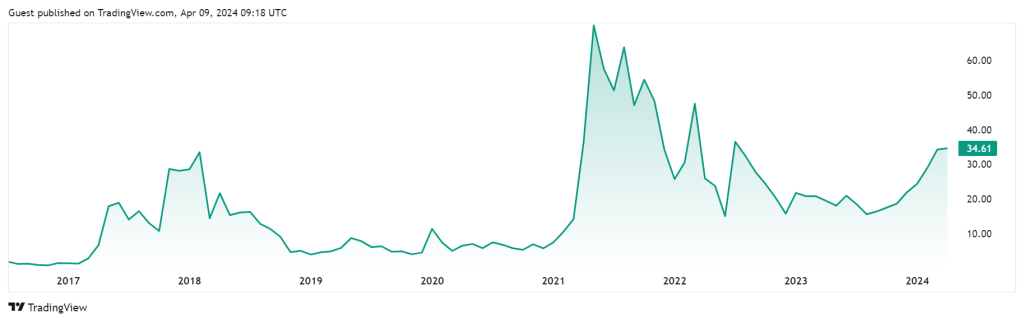

- As of April 10, 2024, the current price of the Ethereum Classic token is $32.86.

- Ethereum Classic’s Fear and Greed Index is 80% (Extreme Greed).

- Investing in Ethereum Classic is ideal when the market has been fearful for a long time and selling when the value is at its peak.

- The all-time high value of the Ethereum Classic was recorded at $167.09 on May 06, 2021.

- The all-time low value of Ethereum Classic crypto was $0.615. on Jul 25, 2016.

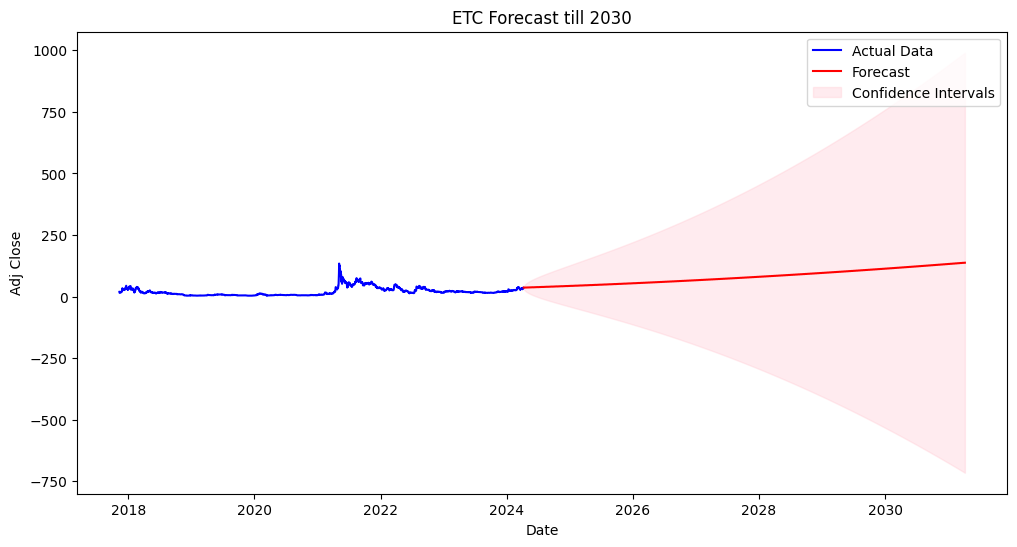

- Our prediction for the Ethereum Classic (using the SARIMA-X model) till the end of 2024 will be the maximum value of $ 43.313722 and may drop to a minimum value of $ 42.382585.

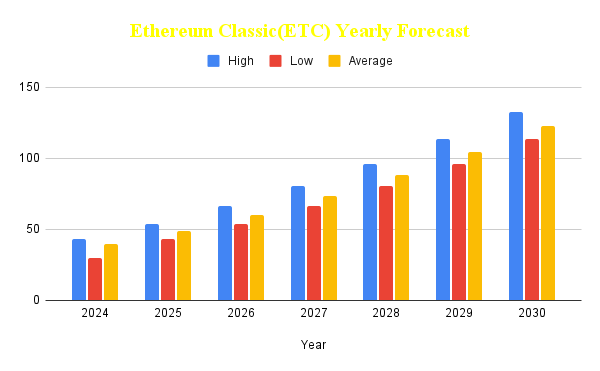

Forecast Ethereum Classic (ETC) Yearly Technical Analysis Table of 2024-2030

| Year | High | Low | Average |

| 2024 | 43.313722 | 29.970011 | 39.84463 |

| 2025 | 54.048344 | 43.349118 | 48.548899 |

| 2026 | 66.473364 | 54.104459 | 60.095699 |

| 2027 | 80.435321 | 66.443688 | 73.279906 |

| 2028 | 96.054542 | 80.411763 | 88.12362 |

| 2029 | 113.301381 | 96.06744 | 104.608991 |

| 2030 | 132.387019 | 113.505021 | 122.711517 |

What is the Future of Ethereum Classic?

The future of Ethereum Classic (ETC) is still being determined, with both potential for growth and challenges to overcome. Here’s a breakdown of some key factors to consider.

Possible Growth Factors

- Continued Ethereum (ETH) dominance: If Ethereum (ETH) maintains its leading position in smart contracts, it could bring more attention and use cases to ETC as a secure alternative with a similar codebase.

- Proof-of-Work (PoW) preference: If concerns arise over the environmental impact or centralization of Proof-of-Stake (PoS) used by ETH, ETC’s commitment to PoW could attract miners and users who value those aspects.

- Community Development: A strong and active developer community can create innovative applications and functionalities for ETC, boosting its utility and value.

Challenges to Consider

- Competition: Many other innovative contract platforms are vying for market share, ETC needs to find ways to differentiate itself.

- Limited Adoption: ETC has a smaller user base and ecosystem than ETH, making it less attractive for developers and businesses to build on.

- Market Volatility: The cryptocurrency market is inherently volatile; ETC’s price can fluctuate significantly.

The Use Cases of the Ethereum Classic

Ethereum Classic (ETC) offers several use cases, some of which are mentioned below.

Decentralized Applications (dApps) and Smart Contracts

- Just like Ethereum (ETH), ETC can be used to build and run dApps, which are applications that operate on a blockchain without a central authority. ETC’s codebase is like the original Ethereum, potentially making it easier for developers to port existing dApps.

Utility and Payments

- The native token of Ethereum Classic, ETC, can be used to pay for transactions and computations on the network. This could be for running dApps, storing data, or making peer-to-peer payments.

- Some businesses are starting to accept ETC as a payment, similar to how Bitcoin is used.

Ethereum Classic Yearly Technical Analysis From 2025-2030

In this part of the post, we will provide the Ethereum Classic yearly technical analysis from 2025 to 2030 using the SARIMA-X model. This data will help you with future Ethereum Classic coin investments. Let’s know more about the predicted value of this coin for the next few years.

Ethereum Classic Yearly Technical Analysis 2025

As per our crypto market analysis, the peak value of Ethereum Classic in 2025 will be around $54.048344, which may reach a lower value of $43.349118. The average trading value will be $48.548899.

Ethereum Classic Yearly Technical Analysis 2026

The Ethereum Classic token in 2026 may touch the highest value of $66.473364, and the lower value may be around $54.104459. The average trading value will be around $60.095699.

Ethereum Classic Yearly Technical Analysis 2027

Our prediction on the Ethereum Classic token price in 2027 might surprise investors. This year, the Ethereum Classic coin may touch the highest value of $80.435321, and the lower value may be around $66.443688. The average trading value will be around $73.279906.

Ethereum Classic Yearly Technical Analysis 2028

We predict the Ethereum Classic coin may reach the maximum value of $96.054542 and the lowest value of $80.411763 in the 2028 calendar year. The average value will be around $88.12362.

Ethereum Classic Yearly Technical Analysis 2029

Our market analysis data expects that the highest value of the Ethereum Classic crypto may reach $113.368854, and it may touch the lowest value of $96.06744 in 2029. The average trading value of this coin will be around $104.608991.

Ethereum Classic Yearly Technical Analysis 2030

Our crypto analyst team predicts that the maximum ETC token price will be around $132.387019, and the lower value may be approximately $113.505021 in 2030. The average value will be about $122.711517.

Methodology

- Utilizing the consistent Ethereum Classic (ETC) Prices, our study involved predicting prices across a spectrum of temporal scopes.

- Long-term forecasting with SARIMA-X involves leveraging its capability to capture trend and seasonality in the data, enabling accurate predictions over extended time horizons.

- SARIMAX models are specifically designed to handle time series data that exhibit stationarity, which means their statistical properties, such as mean and variance, remain constant over time.

- Forecasting periods were set at 2190 days for six-year projections, ensuring comprehensive coverage.

- After completing these analytical processes, the yearly outcomes have been meticulously stratified into High, Low, and Average values.

- Utilizing machine learning algorithms, the output of analytical procedures is represented visually, offering an advanced platform for detecting trends spanning the years ahead.

FAQs on Ethereum Classic Yearly Technical Analysis

Here, we will discuss some crucial questions that might greatly help you. So don’t skip this section.

Q. What is Ethereum Classic used for?

Ethereum Classic (ETC) is a blockchain platform like Ethereum but focuses on staying true to the original code. It’s used for running decentralized applications (dApps), making payments, storing data securely, and potentially as a long-term investment.

Q. What is the difference between Ethereum Classic and Ethereum?

Ethereum Classic (ETC) and Ethereum (ETH) are similar blockchains, but with a key difference. ETC stuck to the original Ethereum code, while ETH changed it for security reasons.

Q. Is Ethereum Classic layer 1?

Yes, Ethereum Classic (ETC) is a layer one blockchain. Layer 1 blockchains are the foundational networks that process transactions and maintain the ledger’s state. They are the core infrastructure upon which other applications and protocols can be built.

Conclusion

This post is all about the Ethereum classic future value prediction, upcoming projects, and potential investment properties considering the use cases. We have provided all the data that indicates the potential of this coin, and our prediction data helps investors regarding future investments.