The ever-evolving cryptocurrency world beckons with the promise of potential gains but also harbors inherent uncertainties. For those considering Ethereum, a prominent player in space, navigating the labyrinth of price predictions can be daunting. This article delves into the Ethereum Monthly Technical Analysis for 2024. Our main aim is to equip you with the knowledge to make informed decisions as you explore the potential of Ethereum for the future.

Overview Ethereum Monthly Technical Analysis for 2024

- As of March 7, 2024, the price of Ethereum is approximately $ $3,777.72. It may change quickly as it’s a volatile market.

- Ethereum’s Fear and Greed Index is 49%(Neutral)

- Investing in Ethereum when the market has been fearful for a long time and selling when greed is at its peak is highly recommended.

- The all-time high value of Ethereum was recorded at $4,878.26 on November 10, 2021.

- The all-time low value of the Ethereum was $0.0433 on October 20, 2015.

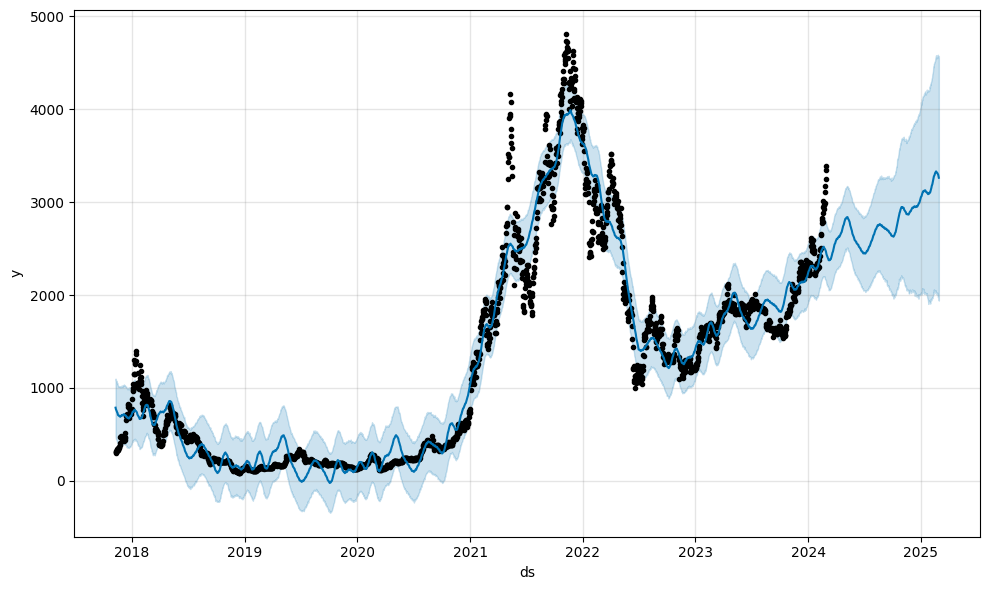

- Our prediction for Ethereum (using the Prophet method) till the end of 2024 will be the maximum value of $3040.76797 and may drop to a minimum value of $2230.709483.

Ethereum Monthly Technical Analysis Table for 2024

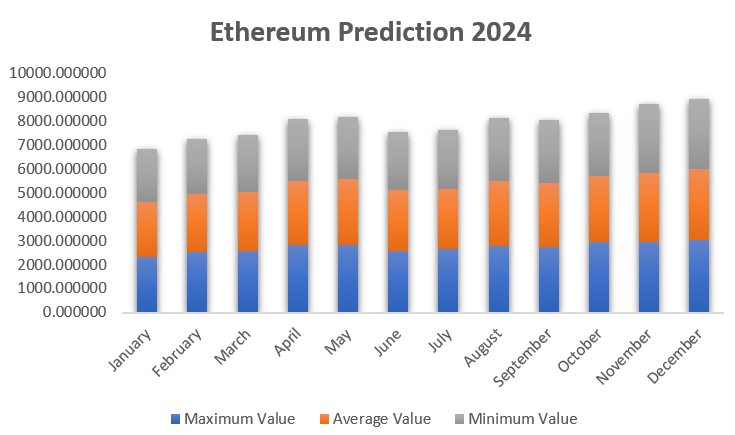

| 2024 | Maximum Value | Average Value | Minimum Value |

| January | 2314.674007 | 2289.190238 | 2230.709483 |

| February | 2520.509205 | 2443.277131 | 2302.412291 |

| March | 2579.938768 | 2445.488063 | 2374.544671 |

| April | 2808.373839 | 2674.209237 | 2587.242983 |

| May | 2839.917565 | 2745.592515 | 2593.64555 |

| June | 2590.010796 | 2515.98445 | 2448.453437 |

| July | 2643.63928 | 2520.533366 | 2446.767068 |

| August | 2764.38534 | 2728.9836 | 2647.551544 |

| September | 2731.950872 | 2689.757094 | 2634.837522 |

| October | 2947.295667 | 2770.937815 | 2628.238797 |

| November | 2945.141752 | 2899.820452 | 2866.895066 |

| December | 3040.760797 | 2962.661758 | 2919.615728 |

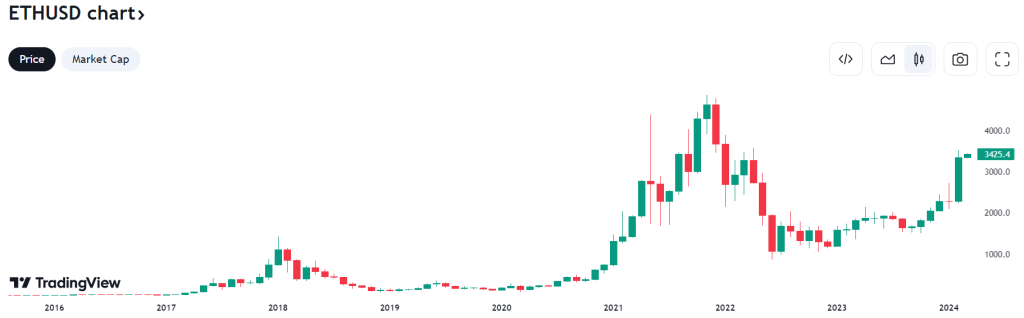

Candle Stick Representation of Ethereum

What Changes can Ethereum Make This Time?

Ethereum is expected to undergo several critical changes in the future, some of which are already actively being developed. Here are a few noteworthy ones:

1. Sharding: This scaling solution aims to increase Ethereum’s transaction processing capacity. Currently, Ethereum can handle around 15-30 transactions per second, which is considered low compared to other blockchains and traditional payment systems. Sharding aims to divide the network into smaller partitions (shards), allowing each shard to process transactions independently and significantly increasing the overall network throughput.

2. The Scourge: This new protocol is designed to enhance Ethereum’s resistance to censorship. It aims to prevent malicious actors from selectively blocking or censoring specific transactions on the network. The Scourge is expected to strengthen the network’s decentralization and security further.

3. Continued development of the Ethereum Virtual Machine (EVM): The EVM is a core component of Ethereum that allows for the execution of smart contracts. Ongoing development efforts focus on improving the EVM’s efficiency and scalability, making it more suitable for handling complex decentralized applications (dApps).

4. Integration with Layer-2 solutions: Layer-2 solutions are built on the Ethereum blockchain and address scalability limitations by processing transactions off-chain before settling them on the main chain. Continued integration with various Layer-2 solutions is expected to improve the user experience and efficiency of dApps built on Ethereum.

It’s important to remember that these are just some of the expected changes, and the exact timeline and implementation details are subject to change as development progresses.

Why Ethereum in 2024?

There are several reasons why Ethereum might be an exciting prospect in 2024, though it’s crucial to remember that the cryptocurrency market is inherently unpredictable and involves significant risks. Here are some key points to consider:

Potential for Continued Growth

- Post-Merge momentum: The successful transition to proof-of-stake (PoS) in 2022 positioned Ethereum for future growth by addressing scalability and sustainability concerns. This positive momentum could continue in 2024.

- Anticipated crypto bull run: Some analysts predict a broader cryptocurrency bull market in 2024, potentially fueled by factors like the Bitcoin halving event (historically linked to bull runs) and increased institutional adoption. Ethereum, as the second-largest cryptocurrency, could benefit from this trend.

- Upcoming upgrades: The year 2024 might see the implementation of Ethereum’s sharding upgrade, aiming to increase transaction processing capacity significantly. This could attract more users and developers, potentially driving value.

Factors to Consider

- Market volatility: The cryptocurrency market remains highly volatile, susceptible to sudden price swings influenced by various factors, including regulatory changes, economic conditions, and social media sentiment. This volatility poses inherent risks for investors.

- Competition: Ethereum faces competition from other innovative contract platforms constantly evolving and vying for market share. The success of Ethereum hinges on its ability to maintain its technological edge and user base.

- Uncertain regulatory landscape: Regulatory uncertainty surrounding cryptocurrencies can create challenges for the industry and impact investor confidence.

What is the Use Cases of the Ethereum?

Ethereum’s capabilities extend beyond just being a cryptocurrency. Its core technology, the Ethereum blockchain, facilitates various applications through features like smart contracts and non-fungible tokens (NFTs). Here are some prominent use cases of Ethereum:

1. Decentralized Finance (DeFi): DeFi applications built on Ethereum enable various financial services without relying on traditional intermediaries. This includes:

- Lending and borrowing: Platforms like Aave and Compound allow users to lend and borrow cryptocurrencies, earn interest, or access liquidity.

- Decentralized exchanges (DEXs): Uniswap and SushiSwap facilitate peer-to-peer cryptocurrency trading without central authority.

- Yield farming involves depositing crypto assets into DeFi protocols to earn rewards, but it carries inherent risks and complexities.

2. Non-Fungible tokens (NFTs): NFTs represent unique digital assets on the Ethereum blockchain, used for various purposes like:

- Digital collectibles: NFTs can represent digital art, music, and other unique items, enabling ownership and trading.

- In-game assets: NFTs are used in certain games to represent ownership of virtual items like characters, skins, or weapons.

- Event tickets: NFTs can be used for event ticketing, offering potential benefits like reduced fraud and easier resale.

Ethereum Monthly Technical Analysis for 2024

According to our detailed market analysis and prediction, the maximum value of Ethereum (using the Prophet Model) in 2024 will be around $3040.760797, and the lower value may touch around $1302.412291. The average trading value will be around $2223.188791.

Monthly Ethereum(ETH) Technical Analysis Chart Stacked Bar Chart

Ethereum Monthly Technical Analysis for February

Our monthly prediction for February 2024 is that the Ethereum coin may reach the high value of $2520.509205 and go down to $2302.412291. The average value will be $2443.277131.

Ethereum Monthly Technical Analysis for March

Our market analysis predicts the highest value of the Ethereum coin in March 2024 will be around $2579.938768, which may go down to $2374.544671. The average trading value will be $2445.488063.

Ethereum Monthly Technical Analysis for April

We expect the highest value of the Ethereum coin in April 2024 to be around $2808.373839, which may be down to $2587.242983. The average trading value will be $2674.209237.

Ethereum Monthly Technical Analysis for May

Our Ethereum Monthly Technical Analysis for May 2024 will reach the maximum value of $2839.917565, and the lower value may be around $2593.645550. The average value will be $2745.592515.

Ethereum Monthly Technical Analysis for June

We expect the Ethereum coin token to reach the highest value of $2590.010796 in June. It may touch the lower value of $2448.453437. The average value will stay around $2525.984450.

Ethereum Monthly Technical Analysis for July

According to our research team, the Ethereum coin will reach the highest value of $2643.639280 and the lowest value of $2446.767068 in July. The average value will be around $2520.533366.

Ethereum Monthly Technical Analysis for August

The prediction of the Ethereum coin for August 2024 will be the highest value of $2764.3853340, and it may touch down to $2647.551544. The average value will be around $2728.983600.

Ethereum Monthly Technical Analysis for September

We predict the Ethereum coin value will reach the maximum of $2731.950872 and may go down to $2634.837522 in September 2024. The average value will be 2689.757094.

Ethereum Monthly Technical Analysis for October

For October 2024, our prediction for the Ethereum coin’s maximum value will be around $2947.295667, which may be down to $2628.238797. The average value will be around $2770.937815.

Ethereum Monthly Technical Analysis for November

The maximum value of the Ethereum coin for November 2024 will be around $2945.141752, which may be down to $2866.895066. The average value will be around $2899.820452.

Ethereum Monthly Technical Analysis for December

Our research team predicts that the Ethereum coin may reach a maximum value of $3040.760797 and be down to $2919.615728 by December 2024. The average trading value will be $2962.661758.

Methodology

- The historical Ethereum dataset from November 9, 2017, to February 28, 2024, has been systematically imported from Yahoo Finance.

- Employing Prophet methodology, Ethereum price forecasting has been executed with a horizon extended to 2024.

- Leveraging the advantages of Prophet, particularly suited for Long Forecasting, the model adeptly focuses on recent data, enhancing precision in trend analysis.

- Forecasting periods were set at 365 days for a one-year projection, ensuring comprehensive coverage.

- Post-execution of these procedural steps, outcomes have been methodically categorized into monthly segments, discerning High, Low, and Average values.

- Visualization techniques, such as graphical representations have been applied to the results, facilitating a comprehensive understanding, and streamlined trend identification for the forthcoming year.

FAQs On Ethereum Monthly Technical Analysis

In this section, we have answered some of the confusing and frequently asked questions that might be helpful for you, so read it carefully.

Q. Can Ethereum reach $50,000 in 2024?

Reaching $50,000 for Ethereum in 2024 is highly unlikely based on current market conditions and historical trends.

Q. What factors influence Ethereum price predictions?

Several factors may influence Ethereum’s predicted value, including.

- Past performance

- Technical analysis

- Market sentiment

- Upcoming developments

- Regulations

Q. What are some alternative ways to assess Ethereum’s potential?

Rather than price prediction, some other ways to access Ethereum’s potential are like

- Ethereum’s technological advancements

- The growth of the Ethereum ecosystem

- Comparison with other cryptocurrencies

Conclusion

In this post, we have analyzed Ethereum in detail, including its future projects, upcoming changes, and use cases. Our deep market research and future prediction data indicate the high potential of this coin regarding future investment. Our data and analysis help you understand this crypto better and recognize its potential for future investment.