The ever-evolving cryptocurrency world beckons with the promise of potential gains but also harbors inherent uncertainties. For those considering Ethereum, a prominent player in space, navigating the labyrinth of Technical Analysis can be daunting. This article delves into the Ethereum Yearly Technical Analysis 2025, and 2030. Our main aim is to equip you with the knowledge to make informed decisions as you explore the potential of Ethereum for the future.

Overview Ethereum Yearly Technical Analysis 2024 to 2030

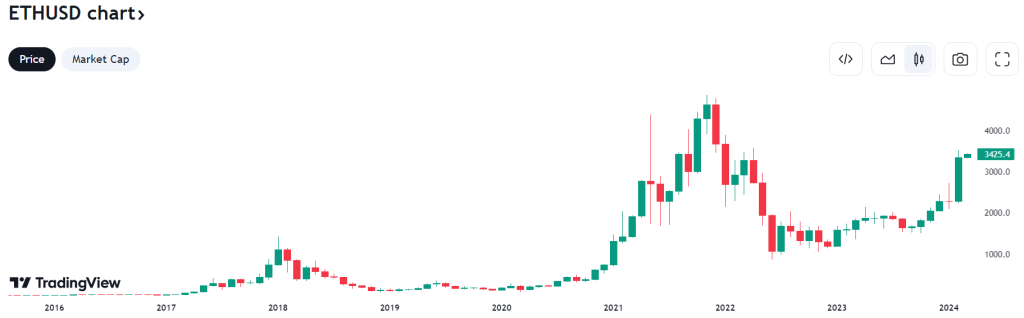

- As of March 7, 2024, the price of Ethereum is approximately $ $3,777.72. It may change quickly as it’s a volatile market.

- Ethereum’s Fear and Greed Index is 49%(Neutral)

- Investing in Ethereum when the market has been fearful for a long time and selling when greed is at its peak is highly recommended.

- The all-time high value of Ethereum was recorded at $4,878.26 on November 10, 2021.

- The all-time low value of the Ethereum was $0.0433 on October 20, 2015.

- Our prediction for Ethereum (using the Prophet method) till the end of 2024 will be the maximum value of $3040.76797 and may drop to a minimum value of $2230.709483.

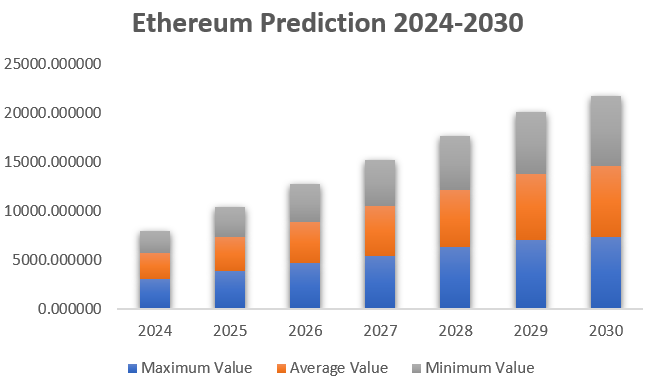

Ethereum Yearly Technical Analysis Table 2024-2030

| Year | Maximum Value | Average Value | Minimum Value |

| 2024 | 3040.760797 | 2641.019622 | 2230.709483 |

| 2025 | 3852.892316 | 3452.490461 | 3055.284271 |

| 2026 | 4655.563994 | 4262.811221 | 3857.941978 |

| 2027 | 5458.587495 | 5073.132911 | 4660.93742 |

| 2028 | 6282.695049 | 5884.568374 | 5472.334871 |

| 2029 | 7090.740148 | 6696.033287 | 6293.132102 |

| 2030 | 7386.309406 | 7227.750387 | 7103.183523 |

Candle Stick Representation of Ethereum

What is the Future of Ethereum?

Predicting the future of any complex system, especially in a rapidly evolving space like cryptocurrency, is inherently tricky. However, considering Ethereum’s current state, ongoing developments, and broader market trends, here’s a glimpse into its potential future:

Growth Potential

- Established ecosystem: Ethereum boasts the most extensive and mature decentralized application (dApp) ecosystem. This established user base and developer community can significantly drive future adoption and innovation.

- Post-Merge benefits: The transition to proof-of-stake (PoS) in 2022 improved Ethereum’s scalability and sustainability, addressing key concerns and potentially attracting more comprehensive institutional investment.

- Upcoming upgrades: The implementation of sharding, expected in the coming years, aims to significantly increase transaction processing capacity, making Ethereum more competitive and scalable.

Challenges and Uncertainties

- Competition: The blockchain landscape constantly evolves, with competing innovative contract platforms like Solana and Cardano vying for market share. Ethereum’s future hinges on its ability to innovate and remain technologically competitive.

- Regulatory landscape: The uncertain regulatory environment surrounding cryptocurrencies can challenge the industry and impact investor confidence. More precise regulations could be crucial for broader adoption.

- Market volatility: The cryptocurrency market is inherently volatile and susceptible to external factors, including economic conditions, regulatory changes, and social media sentiment. This volatility poses a risk for investors.

While Ethereum faces challenges and uncertainties, its established ecosystem, ongoing development efforts, and potential for growth in a maturing market suggest a promising future.

The Use Cases of the Ethereum

Ethereum’s capabilities extend beyond just being a cryptocurrency. Its core technology, the Ethereum blockchain, facilitates various applications through features like smart contracts and non-fungible tokens (NFTs). Here are some prominent use cases of Ethereum:

3. Supply chain management: Ethereum’s transparency and immutability enable tracking goods throughout the supply chain, ensuring:

- Provenance tracking: Consumers can verify the origin and authenticity of products, combating counterfeiting and improving transparency.

- Improved efficiency: Streamlining supply chain processes by automating tasks and reducing reliance on manual verification.

4. Identity and access management: Ethereum can be used to create secure and self-sovereign digital identities, allowing individuals to control their data and access various services:

- Decentralized autonomous organizations (DAOs): DAOs are internet-native communities governed by rules encoded in smart contracts, and Ethereum can facilitate their operations and membership management.

- Secure logins: Ethereum-based solutions can enable secure logins to various applications without relying on centralized password management systems.

Ethereum Yearly Technical Analysis From 2025-2030

Here, we will give you an in-depth market analysis of Ethereum Yearly Technical Analysis from 2025 to 2030. This data is based on the Prophet method; for crypto investors, this data will be helpful in investment. Let’s see the Yearly Technical Analysis for Ethereum for these upcoming years.

Yearly Ethereum Technical Analysis Chart

Ethereum Yearly Technical Analysis 2025

As per our research, the maximum value of Ethereum in 2025 will be around $3852.892316, which may reach a lower value of $3055.284271. The average trading value will be $3452.490461.

Ethereum Yearly Technical Analysis 2026

Our Ethereum crypto Yearly Technical Analysis for 2026 might shock you. This year, the Ethereum coin may touch the highest value of $4655.563994, and the lower value may be around $3857.941978. The average trading value will be around $4262.811221.

Ethereum Yearly Technical Analysis 2027

Our prediction on the Ethereum Coin 2027 might surprise you. This year, the Ethereum coin may touch the highest value of $5458.587495, and the lower value may be around $4660.93742. The average trading value will be around $5073.132911.

Ethereum Yearly Technical Analysis 2028

Our research team predicts the Ethereum coin may reach the highest value of $6282.695049 and the lowest value of $5472.334871 in the 2028 calendar year. The average value will be around $5884.568374.

Ethereum Yearly Technical Analysis 2029

Our market analysis data hints that the highest value of the Ethereum coin may reach $7090.740148, and it may touch the lowest value of $6293.132102 in 2029. The average trading value of this coin will stay around $6696.033287.

Ethereum Yearly Technical Analysis 2030

We predict the Ethereum coin’s maximum value will be around $7386.309406, and the lower value may stick around $7103.183523 in 2030. The average value will stay around $7227.750387.

Methodology

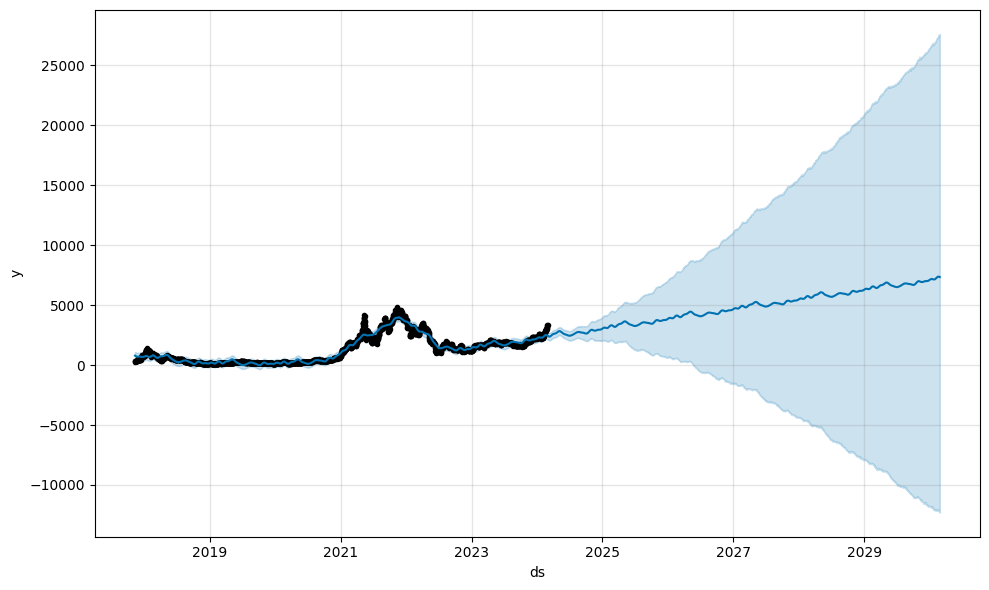

- The Ethereum dataset spanning from November 9, 2017, to February 28, 2024, has been meticulously sourced from Yahoo Finance.

- Employing the Prophet methodology, Ethereum price forecasting has been meticulously conducted, projecting trends up to 2030.

- Capitalising on Prophet’s strengths, especially in Long Forecasting, the model has effectively concentrated on recent data, thereby enhancing accuracy in trend analysis.

- Forecasting periods were tailored to 2,190 days for a comprehensive six-year projection, ensuring thorough coverage.

- Following the execution of these procedural steps, outcomes have been meticulously categorised into monthly segments, discerning High, Low, and Average values.

- Visualisation techniques, including graphical representations, have been seamlessly integrated into the results, facilitating a holistic understanding and streamlined trend identification for the upcoming year.

FAQs On Ethereum Yearly Technical Analysis

In this section, we have answered some of the confusing and frequently asked questions that might be helpful for you, so read it carefully.

Q. Can Ethereum reach $50,000 in 2024?

Reaching $50,000 for Ethereum in 2024 is highly unlikely based on current market conditions and historical trends.

Q. What factors influence Ethereum Technical Analysis?

Several factors may influence Ethereum’s predicted value, including.

- Past performance

- Technical analysis

- Market sentiment

- Upcoming developments

- Regulations

Q. What are some alternative ways to assess Ethereum’s potential?

Rather than Technical Analysis, some other ways to access Ethereum’s potential are like

- Ethereum’s technological advancements

- The growth of the Ethereum ecosystem

- Comparison with other cryptocurrencies

Conclusion

In this post, we have analyzed Ethereum in detail, including its future projects, upcoming changes, and use cases. Our deep market research and future prediction data indicate the high potential of this coin regarding future investment. Our data and analysis help you understand this crypto better and recognize its potential for future investment.