Want to know more about the Uniswap coin and its monthly technical analysis? If yes, then you are at the right place. This post will explore the possible Uniswap Monthly Technical Analysis 2024. While acknowledging the foggy nature of crypto price forecasts, we’ll delve into crucial factors that could steer UNI’s value. Buckle up as we explore the wild ride of DeFi adoption, Uniswap’s innovative spirit, the ever-changing regulatory landscape, and the ever-present volatility that defines the cryptocurrency market.

Overview Uniswap (UNI) Monthly Technical Analysis 2024

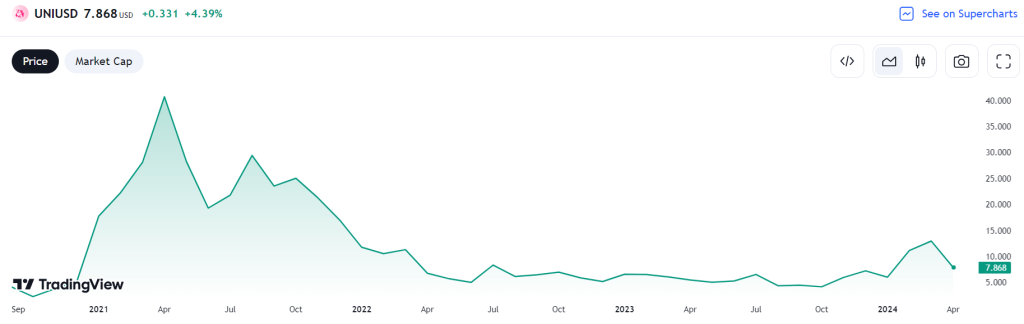

- As of April 17, 2024, Uniswap coin’s price is approximately $$7.06.

- The Fear and Greed Index of the Uniswap Coin is 39% (Fear)

- Investing in Uniswap Coin when the market has been fearful for a long time and selling when greed is at its peak is always recommended.

- The all-time high value of the Uniswap coin was recorded at $44.92 on May 03, 2021.

- The all-time low value of the Uniswap coin was $1.03 on Sep 17, 2020.

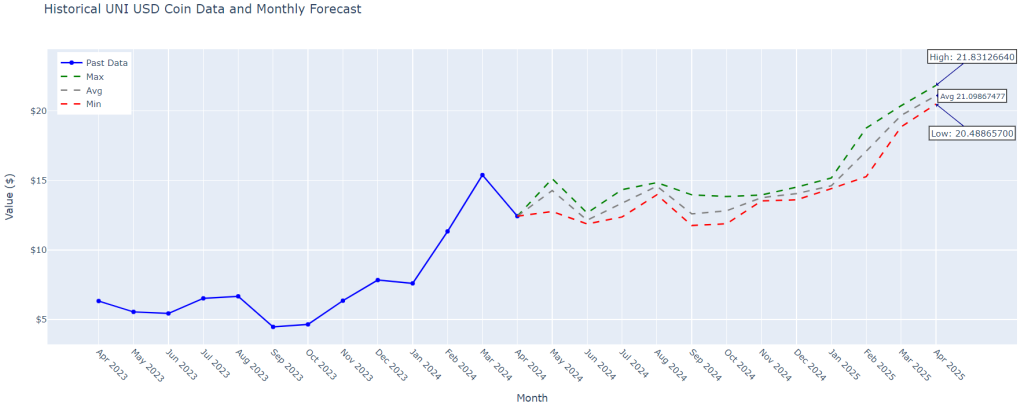

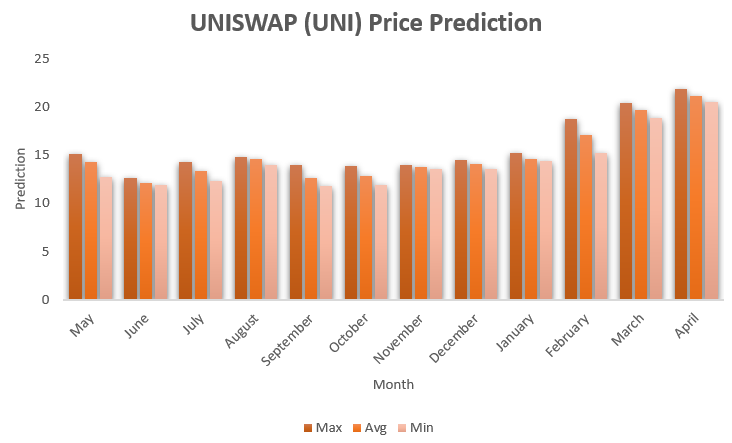

- Our prediction for the Uniswap coin (using the Neural Prophet method) till the end of 2024 will be the maximum value of $ 15.12110329 and may drop to a minimum value of $ 11.75976753.

Forecast Uniswap (UNI) Monthly Technical Analysis Table of 2024

| Month | Max | Min | Avg |

| May | 15.12110329 | 12.76601219 | 14.27255917 |

| June | 12.6611042 | 11.87208557 | 12.14064407 |

| July | 14.33550262 | 12.3715992 | 13.34767342 |

| August | 14.84248352 | 13.97042084 | 14.58324242 |

| September | 13.96624565 | 11.75976753 | 12.5973959 |

| October | 13.84169197 | 11.88643265 | 12.82233524 |

| November | 13.95702362 | 13.53121758 | 13.7616539 |

| December | 14.51429176 | 13.60515404 | 14.05164242 |

| January | 15.17709541 | 14.4097271 | 14.61604881 |

| February | 18.76355934 | 15.27158546 | 17.09592819 |

| March | 20.37018204 | 18.84921646 | 19.6728363 |

| April | 21.8312664 | 20.488657 | 21.09867477 |

What Changes will Uniswap Make in the future?

Here are some potential changes Uniswap can make in the future:

Increased Customization: Uniswap v4 introduced hooks, which allow for the creation of highly customized pools. This trend will likely continue, enabling features like dynamic fees, on-chain limit orders, and even new functionalities.

Improved Scalability: High gas fees have plagued DeFi protocols, including Uniswap. Layer 2 scaling solutions and other innovations can help Uniswap handle more transactions efficiently.

Focus on Developer Adoption: By making the protocol easier to build upon, Uniswap can attract more developers to create novel DeFi applications on its foundation.

Enhanced Liquidity Management: Liquidity is crucial for smooth trading on DEXs. Uniswap can explore new ways to incentivize liquidity providers and ensure sufficient depth in its markets.

Addressing MEV (Miner Extractable Value): Malicious actors can exploit MEV to front-run transactions and extract profits. Uniswap can implement mechanisms to mitigate MEV and protect users.

Why Uniswap in 2024?

Here is a complete breakdown of which one should choose Uniswap in 2024

Potential Upsides

- Market Growth: The crypto market might rally in 2024, especially after the anticipated Bitcoin halving in April. This could benefit Uniswap as a leading DEX.

- Increased Usage: With wider DeFi adoption, Uniswap’s trading volumes and user base could grow, boosting the UNI token’s value.

- Regulatory Clarity: As crypto regulations become more precise, it might bring more stability and attract new investors to Uniswap.

Challenges to Consider

- SEC Lawsuit: The recent SEC notice alleging Uniswap acted as an unregistered security exchange has caused a price drop for UNI. The lawsuit’s outcome could significantly impact Uniswap’s future.

- Competition: Other DEXs are constantly innovating. Uniswap needs to adapt and improve its features to stay competitive.

- Market Volatility: The cryptocurrency market is inherently volatile. UNI’s price could fluctuate significantly even if Uniswap implements successful changes.

What is the Use Cases of the Uniswap?

Uniswap, a decentralized exchange (DEX), offers several critical use cases that benefit cryptocurrency traders and liquidity providers. Let’s discuss more about it below.

Liquidity Providing

- Earning Rewards: Users can contribute cryptocurrency holdings to liquidity pools, facilitating trading between tokens. In return, they earn a portion of the trading fees associated with that pool.

- Market Liquidity: LPs are crucial in maintaining market liquidity at Uniswap. By providing tokens, they ensure smooth user trading by enabling efficient exchange between different cryptocurrencies.

Decentralized Governance (UNI Token)

- Voting Rights: Uniswap’s UNI token grants holders voting rights in the Uniswap DAO (Decentralized Autonomous Organization). This allows them to make crucial decisions regarding the protocol’s future development and upgrades.

- Community-Driven Future: The DAO structure empowers Uniswap’s community to shape its evolution, fostering a collaborative approach to its growth.

Uniswap (UNI) Monthly Technical Analysis for 2024

According to our market research team, the maximum value of the Uniswap (UNI) coin (using the Neural Prophet Model) in 2024 may reach around $15.12110329, and the lower value will be around $11.75976753. We have given the monthly technical analysis for UNI Coin 2024, which will help you to understand this coin’s potential in a better way.

Uniswap Monthly Technical Analysis for May 2024

Our crypto experts predict the value of the UNI coin in May 2024 will reach the maximum value of $15.12110329, and the lower value may be around $12.76601219. The average trading value will be $ 14.27255917.

Uniswap (UNI) Monthly Technical Analysis for June 2024

Our research team expects the Uniswap coin to reach the highest value of $12.6611042 in June. It may touch the lower value of $ 11.87208557. The average trading value will be $ 12.14064407.

UNI Monthly Technical Analysis for July 2024

According to our research team, the Uniswap coin will reach the highest value of $14.33550262 and the lowest value of $12.3715992 in July. The average trading value will be $ 13.34767342.

Uniswap Monthly Technical Analysis for August 2024

The FIL monthly technical analysis for August 2024 will be the highest value of $14.84248352, which may touch down to $13.97042084. The average trading value will be $ 14.58324242.

Uniswap Monthly Technical AnalysisFor September 2024

Our prediction says the Uniswap token value will reach the maximum of $13.96624565. and may go down to $11.75976753 in September 2024. The average trading value will be $ 12.5973959.

Uniswap Monthly Technical Analysis for October 2024

For October 2024, our prediction for the Uniswap coin’s maximum value will be around $13.84169197, which may be down to $ 11.88643265. The average trading value will be $ 12.82233524.

Uniswap Monthly Technical Analysis for November 2024

The maximum value of the UNI coin for November 2024 will be around $13.95702362, which may be down to $ 13.53121758. The average trading value will be $13.7616539.

Uniswap Monthly Technical Analysis for December 2024

Our research team predicts that the Uniswap coin may reach a maximum value of $14.51429176 and be down to $ 13.60515404 by December 2024. The average trading value will be $ 14.05164242.

Methodology

- The Uniswap (UNI7083) dataset sourced from Yahoo Finance spans from September 18, 2020, to April 14, 2024, providing crucial data for in-depth analysis and predictive modeling.

- Utilizing Neural Prophet, accurate forecasts for UNI7083 prices are ensured, leveraging sophisticated algorithms designed to capture intricate time-series patterns within financial markets.

- Performance metrics for Neural Prophet include a Mean Absolute Error (MAE) of 1.43, a Root Mean Square Error (RMSE) of 2.07, and a Loss value of 0.0059 after 5000 training epochs, demonstrating the model’s effectiveness.

- Forecasting intervals are configured for 365 days, facilitating comprehensive one-year projections essential for market trend analysis.

- Following forecasting, results are segmented monthly, distinguishing between High, Low, and Average values, facilitating detailed analysis of price movements.

- Improved visualizations aid in interpreting forecasted trends and market dynamics, providing valuable insights for informed decision-making processes.

FAQs on Uniswap Monthly Technical Analysis

Here, we have answered some of the frequently asked questions, which will help you understand more about the Uniswap coin.

Q. Who owns Uniswap?

Uniswap isn’t owned by a single entity in the traditional sense. It’s a decentralized protocol, meaning its development is overseen by a community, and its core functionality operates on the blockchain.

Q. What problem does Uniswap solve?

Uniswap cuts through the liquidity hurdle that plagues decentralized exchanges (DEXs). Unlike traditional exchanges where buyers and sellers match orders, Uniswap utilizes automated liquidity pools.

Q. Is Uniswap open source?

Yes, Uniswap is open-source. This is a significant feature of the protocol.

Conclusion

Our monthly technical analysis for the UNI coin is based on current market trends and potential future technical analysis; this data will help investors understand the potential of this coin in terms of investment growth and upcoming profitable projects. If you have any questions, feel free to ask us. Thanks.