Want to know more about the Uniswap coin and its Yearly Technical Analysis? If yes, then you are at the right place. This post will explore the possible Uniswap Yearly Technical Analysis 2025-2030. While acknowledging the foggy nature of crypto price forecasts, we’ll delve into crucial factors that could steer UNI’s value. Buckle up as we explore the wild ride of DeFi adoption, Uniswap’s innovative spirit, the ever-changing regulatory landscape, and the ever-present volatility that defines the cryptocurrency market.

Overview Uniswap (UNI) Yearly Technical Analysis 2024 to 2030

- As of April 17, 2024, Uniswap coin’s price is approximately $$7.06.

- The Fear and Greed Index of the Uniswap Coin is 39% (Fear)

- Investing in Uniswap Coin when the market has been fearful for a long time and selling when greed is at its peak is always recommended.

- The all-time high value of the Uniswap coin was recorded at $44.92 on May 03, 2021.

- The all-time low value of the Uniswap coin was $1.03 on Sep 17, 2020.

- Our prediction for the Uniswap coin (using the Neural Prophet method) till the end of 2024 will be the maximum value of $ 15.12110329 and may drop to a minimum value of $ 11.75976753.

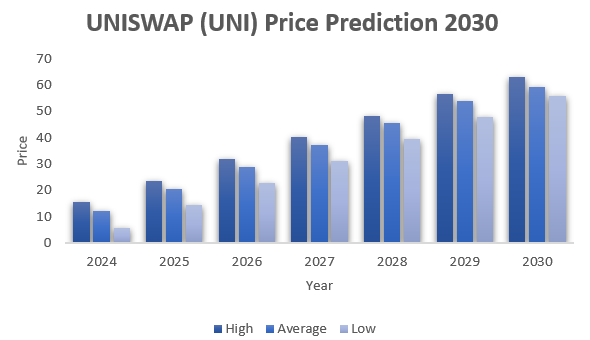

Uniswap (UNI) Yearly Technical Analysis Table From 2025-2030

| Year | High | Low | Average |

| 2024 | 15.38644 | 5.7480121 | 12.283353 |

| 2025 | 23.453808 | 14.409727 | 20.652443 |

| 2026 | 31.787081 | 22.743343 | 28.976199 |

| 2027 | 40.113766 | 31.075865 | 37.299739 |

| 2028 | 48.429794 | 39.398621 | 45.62948 |

| 2029 | 56.759212 | 47.72514 | 53.970154 |

| 2030 | 63.273239 | 56.055321 | 56.055321 |

What is the Future of Uniswap?

The future of Uniswap is uncertain but holds promise. Here’s a breakdown of some key factors to consider:

Potential Growth Drivers

- Decentralized Finance (DeFi) Adoption: As DeFi continues to gain traction, Uniswap, a prominent DEX, could benefit from increased trading volume and user base.

- Innovation: Uniswap’s v3 update introduced concentrated liquidity and multiple fee tiers, showcasing its commitment to improvement. Further innovations could solidify its position.

- Regulatory Clarity: Clearer cryptocurrency regulations might create a more stable environment, attracting new investors to Uniswap.

Challenges and Uncertainties

- Uniswap vs. SEC Lawsuit: The ongoing lawsuit by the SEC alleging Uniswap acted as an unregistered security exchange is a significant hurdle. The outcome could significantly impact Uniswap’s operations and user confidence.

- Competition: The DEX landscape rapidly evolves, with rivals offering innovative features. Uniswap needs to adapt and improve to stay ahead continuously.

- Volatility of Market: The cryptocurrency market is inherently volatile, and UNI’s price could fluctuate significantly regardless of Uniswap’s performance.

Possible Future Developments

- Increased Customization: Uniswap might introduce tools for more customizable token pools, enabling features like dynamic fees and on-chain limit orders.

- Improved Scalability: Solutions like Layer 2 scaling could help Uniswap handle more transactions efficiently and reduce gas fees.

- Focus on Developer Adoption: Making it easier to build on the Uniswap protocol could attract more developers to create novel DeFi applications.

What is the Use Cases of the Uniswap?

Uniswap, a decentralized exchange (DEX), offers several critical use cases that benefit cryptocurrency traders and liquidity providers. Let’s discuss more about it below.

Swapping Tokens

- Core Functionality: Uniswap allows users to swap between various ERC-20 tokens seamlessly, the native token standard for the Ethereum blockchain.

- Permissionless Listing: Unlike traditional exchanges with listing requirements, Uniswap enables trading any ERC-20 token if there’s a liquidity pool. This fosters innovation and accessibility for new projects.

Decentralized Governance (UNI Token)

- Voting Rights: Uniswap’s UNI token grants holders voting rights in the Uniswap DAO (Decentralized Autonomous Organization). This allows them to make crucial decisions regarding the protocol’s future development and upgrades.

- Community-Driven Future: The DAO structure empowers Uniswap’s community to shape its evolution, fostering a collaborative approach to its growth.

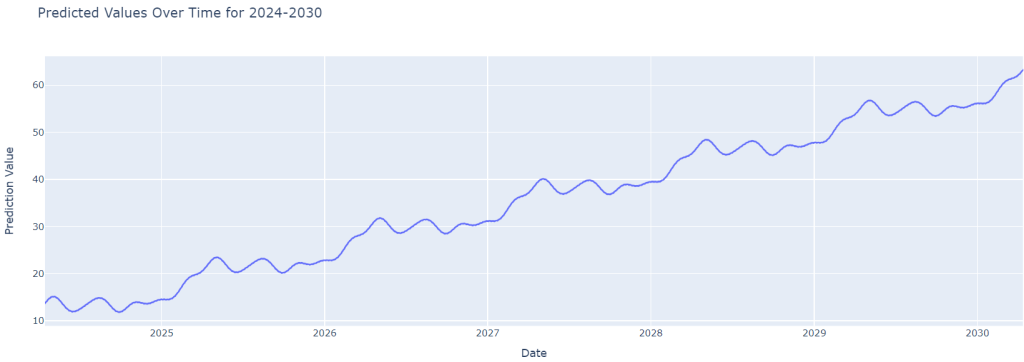

Uniswap Yearly Technical Analysis From 2025-2030

This section will offer market research and analytic Uniswap Yearly Technical Analysis from 2025 to 2030. This data is based on the Neural Prophet method and will help you with future investments in Uniswap coins. Let’s look at the overall data throughout these years.

Uniswap Yearly Technical Analysis 2025

As per our research, the maximum value of Uniswap coin in 2025 will be around $23.453808, which may reach a lower value of $14.409727. The average trading value will be $ 20.652443.

Uniswap Yearly Technical Analysis 2026

Our prediction of the Uniswap Coin 2026 might surprise you. This year, the Uniswap coin may touch the highest value of $ 31.787081, and the lower value may be around $ 22.743343. The average trading value will be around $28.976199.

Uniswap Yearly Technical Analysis 2027

Our prediction on the Uniswap Coin 2027 may touch the highest value of $40.113766, and the lower value may be around $ 31.075865. The average trading value will be around $ 37.299739.

Uniswap Yearly Technical Analysis 2028

Our research team predicts the Uniswap coin may reach the highest value of $48.429794 and the lowest value of $39.398621 in the 2028 calendar year. The average value will be around $ 45.62948.

Uniswap Yearly Technical Analysis 2029

Our market analysis data hints that the highest value of the Uniswap coin may reach $56.759212, and it may touch the lowest value of $47.72514 in 2029. The average trading value of this coin will stay around $ 53.970154.

Uniswap Yearly Technical Analysis 2030

Our Uniswap Yearly Technical Analysis says the maximum value will be around $63.273239, and the lower value may stick around $56.055321 in 2030. The average value will stay around $ 56.055321.

Methodology

- Our meticulously curated dataset for UNI7083, sourced from Yahoo Finance, encompasses September 18, 2020, to April 14, 2024, providing invaluable historical pricing and market data essential for thorough analysis and forecasting.

- Leveraging the sophisticated capabilities of Neural Prophet, we achieve precise forecasts for UNI7083 prices up to the year 2024. Neural Prophet’s prowess lies in its adeptness at discerning intricate patterns within time-series data, making it particularly well-suited for cryptocurrency market forecasting.

- Our forecasting methodology spans 2190 days, covering a six-year timeframe, facilitating a comprehensive examination of market trends. This extended duration lets us glean valuable insights into potential price movements and underlying market dynamics.

- Following the forecasting process, we segment our results into monthly intervals. This structured approach enables a closer scrutiny of price dynamics by delineating High, Low, and Average values for each month.

- To enhance the accessibility and clarity of our forecasts, we employ advanced visualization techniques. We offer a holistic perspective on predicted trends through visually intuitive graphical representations, fostering better pattern recognition and a deeper understanding of market dynamics. Ultimately, this empowers data-driven decision-making processes.

FAQs on Uniswap Yearly Technical Analysis

Here, we have answered some of the frequently asked questions, which will help you understand more about the Uniswap coin.

Q. Who owns Uniswap?

Uniswap isn’t owned by a single entity in the traditional sense. It’s a decentralized protocol, meaning its development is overseen by a community, and its core functionality operates on the blockchain.

Q. What problem does Uniswap solve?

Uniswap cuts through the liquidity hurdle that plagues decentralized exchanges (DEXs). Unlike traditional exchanges where buyers and sellers match orders, Uniswap utilizes automated liquidity pools.

Q. Is Uniswap open source?

Yes, Uniswap is open-source. This is a significant feature of the protocol.

Conclusion

Our Yearly Technical Analysis for the UNI coin is based on current market trends and potential future technical analysis; this data will help investors understand the potential of this coin in terms of investment growth and upcoming profitable projects. If you have any questions, feel free to ask us. Thanks.