BNB is the native token of the BNB Chain ecosystem. At the time of its launch, it was an ERC-20 token which was later migrated to its blockchain. Two years later, BNB can be found within decentralized applications, DeFi protocols, and gas fee payments for Smart Chain and Beacon Chain. Its evolution has allowed BNB Coin to become an infrastructure asset, garnering both institutional interest and technical development necessary to secure their position as a scalable underpinning of the burgeoning Web3 economy.

BNB Price Analysis For July 21, 2025

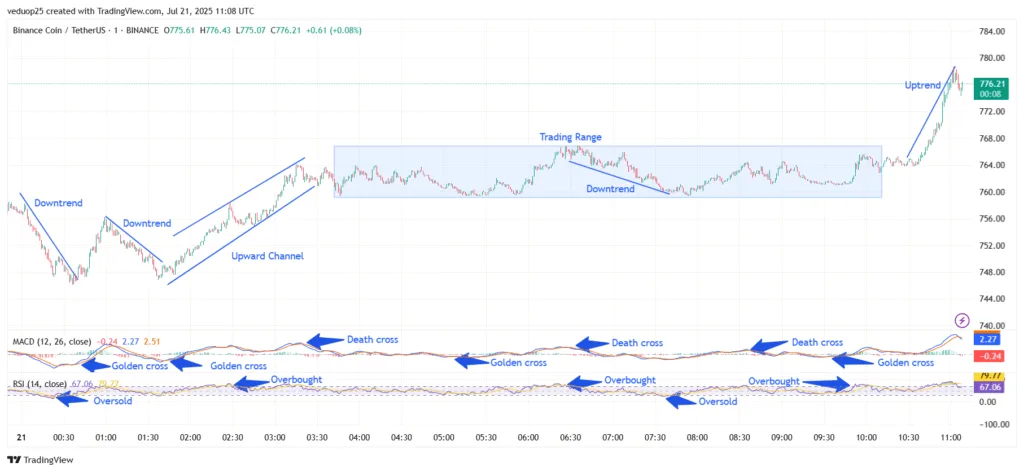

The price analysis shows a volatile mix of trends, breakouts, and consolidation phases supported by clean RSI and MACD signals. the coin began the session around 00:00 with a sharp downtrend, dragging the price from around $774 to a low of $758 by 00:45. This early fall triggered an oversold RSI zone, and the MACD posted a golden cross right after, hinting at a recovery.

From 01:00 to 01:45, BNB made a brief bounce but failed to hold, forming a smaller lower high that confirmed a short-term bearish structure. Another downtrend followed till 02:00, with sellers pressing the coin toward $754, marking the second oversold RSI zone of the night. Momentum shifted post-02:00 as the BNB Price reversed and entered a clear upward channel from 02:00 to 03:30. Bulls drove a strong rally from $754 to $771, with RSI entering overbought territory near the top. However, by 03:30, a death cross showed up on MACD, and price action began to stall.

Chart 1- BNB/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, July 21, 2025

Between 04:00 and 06:45, the BNB Price entered a broad trading range between $762 and $769. At 06:45, a short downtrend emerged, and BNB dipped to $758 again by 07:30, marking the third oversold RSI tag of the day. From 08:00 to 10:45, the BNB Coin stayed inside the same range, forming a base between $760 and $766, setting the stage for a late recovery. Around 10:50, BNB broke out sharply from the upper resistance of the range, confirming a clean breakout. In the final 10 minutes, from 10:50 to 11:00, BNB spiked to $780, with RSI once again hitting overbought and MACD confirming strength with another golden cross.

BNB Chain Scales Up for High-Speed Future with Major Technical Upgrades

BNB Chain is preparing to handle the next phase of on-chain growth by raising its block gas limit to 1 gigagas, a tenfold increase aimed at scaling throughput for high-volume use cases. The upgrade is expected to support up to 5,000 DEX swaps per second and facilitate over 20,000 transactions per second across complex actions like restaking and yield strategies.

To achieve this, BNB Chain will introduce a new Rust-based client built on Ethereum’s Reth, tailored specifically for BSC. This client enhances memory management, node syncing, and execution performance through multi-threading. The network will also implement “Super Instructions” to reduce bottlenecks by compressing frequent smart contract operations into single commands, especially useful in areas like launchpads and DEX activity. As BNB Chain scales technically, it also marks a major milestone, eight years since its ICO. Launched at $0.15 in 2017, the coin now trades around $703, benefiting from mechanisms like Auto-Burn, which has reduced total supply to 139.28 million. Institutional interest in BNB Coin is also rising, with at least one firm planning to hold $1 billion worth in reserves.

BNB Price Outlook Strengthens as Chain Upgrades Target High-Volume Growth

The recent upgrades outlined by chain mark a strategic shift toward high-speed, institutional-grade infrastructure. By lifting the block gas limit to 1 gigabytes and introducing a Rust-based client, chain is not only improving performance but also positioning itself to support future demand from trading, restaking, and DeFi strategies. Features like Super Instructions and enhancements to the StateDB layer show a strong technical focus on reducing latency and execution time.

With the coin already trading near $703 and institutional entities planning to hold large reserves, the BNB Price could gain further momentum. If adoption continues and technical upgrades deliver on scalability promises, analysts could see a sustained BNB price breakout in the coming quarters. Overall, the chain’s roadmap reflects confidence in supporting larger workloads without sacrificing performance—an essential step in securing its long-term growth and market relevance.