As the native token of the Chainlink network, LINK plays a key role in powering secure data connections for smart contracts. This Chainlink price analysis tracks price movements using simple but reliable tools like RSI, MACD, and trend channels to highlight possible breakouts and shifts in direction. While major developments like Project Acacia add real-world value and strengthen long-term confidence in LINK, its price still reacts to overall market trends and news around partnerships or adoption. This analysis outlines important support and resistance zones along with key momentum signals, giving traders a clear view of how to handle LINK’s changing price behavior.

LINK Price Analysis For August 29, 2025

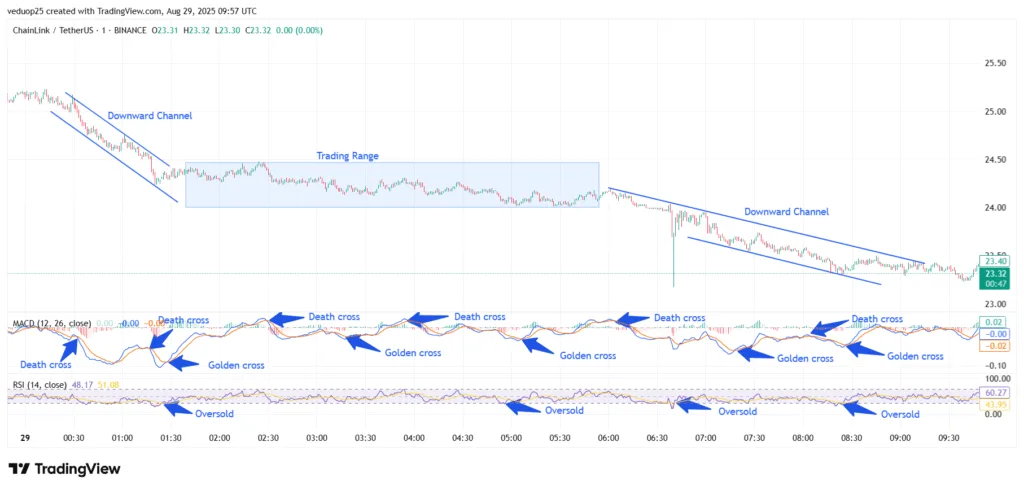

The LINK price analysis shows a clear bearish trend with short phases of consolidation before further downside. The session opened near $25.50, where the Chainlink Price faced early selling pressure. By 00:30 UTC, LINK entered a downward channel, pulling the price below $25.00.

Around 01:00 UTC, the price moved into a trading range between $24.80 and $24.20. For the next few hours, LINK Coin traded sideways within this zone, consolidating earlier losses. The RSI also dipped into oversold zones near 01:30 UTC, showing weak buying interest. By 03:30 UTC, the LINK Price attempted a minor recovery but stayed inside the range. Momentum remained muted, with sellers quick to reject upward moves near $24.60. Around 05:00 UTC, another death cross on the MACD signaled further weakness, and the Chainlink Price stayed closer to $24.20. The lack of strong volume made this period mostly consolidative but still tilted bearish.

Chart 1- LINK/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, August 29, 2025

The next decisive shift occurred at 06:30 UTC, when LINK broke below the range and began a new downward channel, where it sold down heavily toward $23.40 as a strong continuation of the downtrend. MACD again confirmed all the way down with multiple death crosses, while RSI crept back toward oversold levels. Even during short-lived rebounds, all golden crosses failed very quickly, confirming that sellers kept the pressure on.

At 07:00 UTC, LINK Coin moved sharply from $23.30 to just below $23.20 before flatlining quickly back up toward $23.30. From around 08:00 to 09:30 UTC, LINK price continued to trade at the top of the channel, in a somewhat lower trending price movement with no clear upside price direction.

U.S. Commerce Department Adopts Blockchain Oracles for Economic Data

The U.S. Department of Commerce has partnered with blockchain oracles Chainlink and Pyth to publish key economic data on-chain, marking a major step toward government adoption of decentralized technology. Under this initiative, Pyth will provide gross domestic product (GDP) statistics, while Chainlink will deliver data from the Bureau of Economic Analysis, including real GDP, personal consumption expenditures, and private domestic sales.

The move supports the Trump administration’s transparency agenda, aiming to make critical economic data directly verifiable through blockchain networks. By distributing figures on-chain, citizens, institutions, and analysts gain access to immutable records without reliance on intermediaries. This approach enhances accountability in government spending and strengthens trust in public statistics.

Blockchain oracles guarantee a secure bridge between traditional databases and decentralized networks, hence guaranteeing the reliable transmission of sensitive information. Their institutionalization with government systems signifies the growing confidence in decentralized data infrastructure. Officials expect decentralized to carry over into other departments and be a model for even more expansive use of blockchain technology across the various divisions of public administration. This collaboration highlights how blockchain can revolutionize access to public information.

Outlook on Chainlink Price Prediction

The integration of the U.S. Department of Commerce with blockchain oracles signals a meaningful shift for the industry, and its impact on Chainlink Price prediction cannot be overlooked. Chainlink’s oracle service will likely see better demand now that real GDP numbers, personal consumption expenditures, and domestic sales data are being provided on-chain. This not only strengthens the trust Chainlink has built because of the reliable services offered through an oracle, but also expands the long-term utility that Chainlink can derive from the Chainlink network, which has been a historical driver for LINK Price momentum.

As governments use a specialized blockchain for immutable records, transparency in government data can foster institutional trust in decentralized services and associated systems. This partnership reflects an encouraging narrative for LINK Price prediction based on a strong real-world utility and increases trust that LINK Coin is well-positioned to benefit from an expanding market adoption as both public and institutional sector acceptance increases through rapid integration.