Conflux (CFX) is a next-generation Layer-1 blockchain that leverages the Conflux blockchain’s native proof-of-work consensus and directed acyclic graph (DAG) technologies to achieve extremely high throughput without sacrificing decentralization, speed, or security in its decentralized applications (dApps). It has a very unique consensus mechanism called Tree-Graph to maximize project speed. The double ledger consensus mechanism and high-performance infrastructure provide many opportunities for dApps while allowing project founders to follow a permissionless route to financial success; it is an innovative approach to achieving maximum security and user privacy. Projects can grow real-world businesses, cross-border settlements, and next-gen blockchain infrastructure. The Conflux Token powers network transactions, staking, or governance. This is the only regulatory-compliant public blockchain in all of China and is positioned to bridge blockchains in both Eastern and Western regions. Conflux Token (CFX) has been gaining significant attention in recent months in real-world finance!

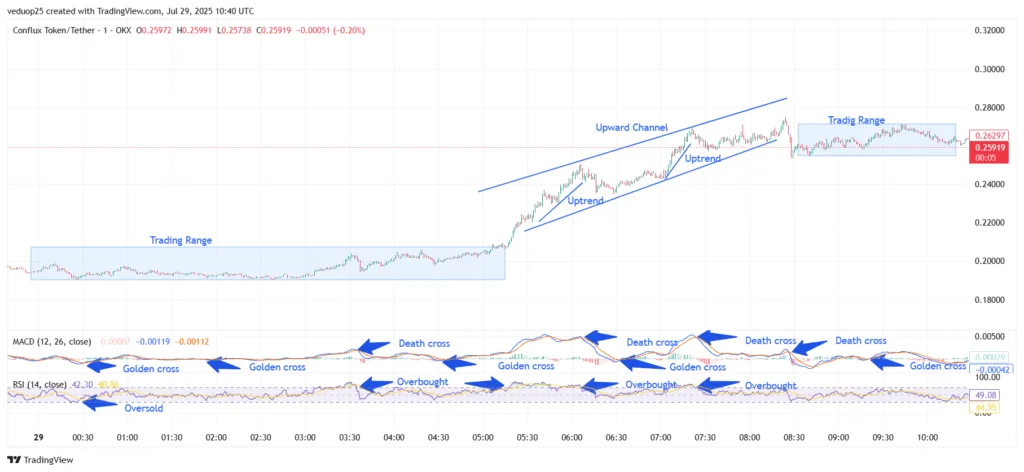

CONFLUX Price Analysis For July 29, 2025

CFX Price Analysis: August 30, 2025

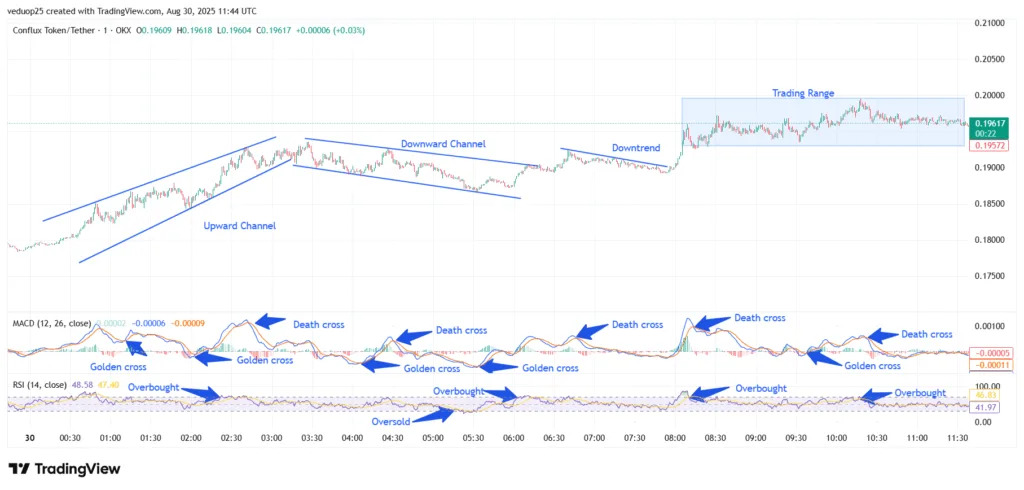

The CFX price analysis shows a clear shift in market phases, starting with an upward channel, followed by a downward channel, an extended downtrend, and finally a trading range. The session opened around 00:30 UTC with a steady climb inside an upward channel. The CFX Price moved higher with consistent buying strength, forming higher highs and higher lows. MACD golden crosses confirmed bullish sentiment, while RSI touched overbought levels, showing demand pressure. This phase extended until nearly 02:30 UTC, marking the strongest bullish stretch of the day.

After this, between 02:30 and 04:00 UTC, the market entered a downward channel. Sellers gained momentum, and the CFX Price pulled back from earlier highs. By 05:00 UTC, the trend turned into a more direct downtrend, lasting until around 07:30 UTC. The Conflux Token kept slipping lower with limited recovery attempts. MACD stayed mostly bearish with repeated death crosses, while RSI touched oversold areas, confirming heavy selling dominance during this window.

Chart 1- CFX/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, August 30, 2025

At 08:00 UTC, CFX attempted a recovery but faced resistance. Price showed small spikes but failed to sustain, moving back down quickly. The MACD flashed golden crosses, but these were weak, and RSI moved briefly into overbought before normalizing. This phase showed indecision with no clear breakout. MACD flattened with frequent short crossovers, while RSI hovered around neutral, reflecting the lack of strong momentum.

Binance to Temporarily Suspend CFX Deposits

Conflux (CFX) deposits and withdrawals will be temporarily suspended by Binance for the upcoming hard fork and network upgrade, as both projects are key milestones for the Conflux Network to enhance performance, security, and scaling. Known for its Tree-Graph consensus mechanism, Conflux has always focused on delivering high throughput without losing decentralization. The Conflux upgrade will build on those strengths and ready the ecosystem for greater adoption and more advanced use cases. Binance has stated that while deposits and withdrawals will be temporarily suspended, trading for CFX will not be affected on spot markets.

This means trade buying and selling of CFX can continue while the deposit and deposit withdrawals are suspended. The suspension is done solely as a safety measure. While the deposits, withdrawals trading are temporarily halted, the will be no movement of funds, in theory. Therefore, there is no risk of lost transactions, no stale balances, and no replay attacks during a network upgrade. This highlights Binance’s commitment to security and reliability, while solidifying Conflux for a more scalable and powerful future.

Outlook for CFX Price After Binance Suspension

The temporary Binance CFX halt comes at a pivotal time in the Conflux ecosystem, with a network hard fork and upgrade likely to create upward price movement in the short term. Historically, large-scale blockchain upgrades create short-term volatility but result in a transition to stronger fundamentals after confirming success. During the temporary suspension, CFX trading activity will remain available, which could create speculative moves ahead of the planned upgrade.

If the transition to a new version of the network is smooth, coupled with new features that improve scalability and security, the Conflux Token could gain new market fund flow and experience a breakout above immediate local resistance. For now, the price outlook is cautiously optimistic, with the $0.2000 mark as the leading resistance zone to watch. If you are able to get a confirmed breakout above this zone, that could lay the groundwork for a stronger price trend higher.