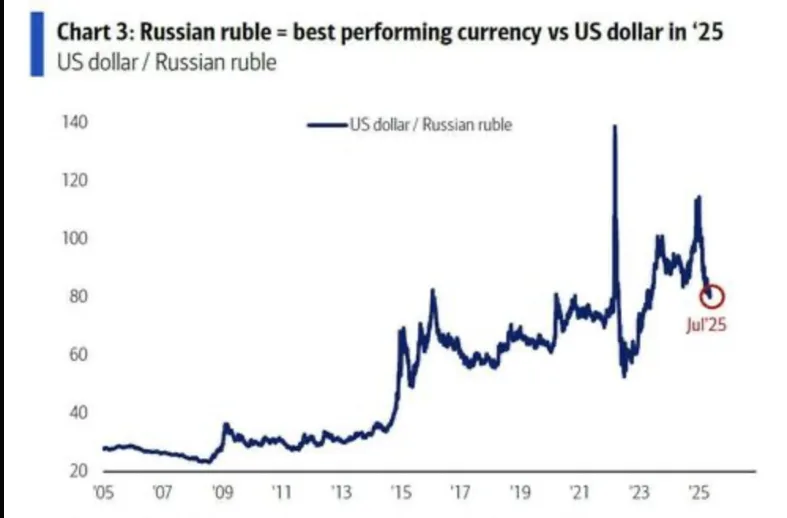

The Russian ruble has outperformed all other currencies in 2025, rising 42% against the US dollar. A dollar now costs fewer rubles because of a large decline in the exchange rate, according to data from BofA Global Research. Thus, these points to monetary policies, energy exports, changing geopolitical trade flows, and strong demand in the currency market. Additionally, the movement has drawn attention from traders all over the world because it marks a significant reversal from years of volatility.

Russian Ruble Rally Shakes Global Currency Trading Patterns

Over the previous 20 years, there has been instability in the USD/RUB trend. The period from 2005 to 2014 saw a stable exchange rate. However, it peaked in 2014–2015 as a result of sanctions and declines in oil prices. Furthermore, political instability around the world is blamed for a further rise in 2022–2023.

An unexpected turnabout has now occurred in 2025, as the ruble is rapidly strengthening. Strong energy revenues and stricter capital controls have been the main drivers of the rally. Experts also point out that Russia is increasingly using alternative trade settlement techniques.

Will Market Moves Reshape Currency Market Dynamics?

The USD/RUB line exhibits historic highs and steep drops in the latest BofA chart, which spans 2005 to mid-2025. A circled July 2025 marker depicts a sudden surge in rubles and the steepest drop in years. As a result, buyers now require fewer rubles for every dollar.

Traders face both opportunities and risks as a result of these fluctuations. As speculative positions aim to profit from the fluctuating exchange rate, the currency market has reacted with increased activity. Furthermore, a lot of analysts now reevaluate their projections for the year’s final numbers.

Russian Ruble Outlook Remains Uncertain Amid Volatility

The ruble may continue on its current path if capital flows are kept under control and energy exports remain strong. But volatility is likely to continue given the currency’s history of sharp reversals. Thus, commodity prices, foreign policy choices, and investor confidence will all have an impact on future exchange rates.

Could the Russian Ruble Sustain Gains Through Year-End?

The Russian ruble has gained global attention due to its outstanding 2025 performance. Its rapid rise shows how political and economic concerns can change market dynamics. Furthermore, even though the rally carries a high risk, investors may be able to make money. The upcoming months will test the underlying fundamentals’ capacity to maintain consistent strength. This year’s ruble story could serve as a case study in currency market volatility and resiliency.