The daily movement of TAO Price maintained a confined range through which it moved from $340 support until reaching the $365 resistance level. Bittensor Price showed various attempts to break out, but each failed as momentum continuously reversed direction. The MACD displayed numerous golden and death crosses, demonstrating market indecisiveness about TAO Coin. The RSI indicator showed unpredictable movements traced between the overbought and oversold areas due to spontaneous shifts in market buying and selling activity. The TAO maintained a prolonged consolidation state while showing brief temporary movement. Current forces between buyers and sellers maintain an equal state of balance. This section analyzes Bittensor’s price reaction to the recent market event by studying the TAO ecosystem.

TAO Price Analysis for April 28, 2025

TAO Coin initially traded at $362.6 on the previous day. The price of Bittensor kept a steady movement between specific definitions that faced upward resistance at around $365 and downward support at $340. At 03:00 UTC, the MACD displayed its first early sign of momentum uncertainty, which later transformed into an indicator of bullish potential. Temporary support allowed the TAO Price to rise, following the second golden cross at 11:30 UTC. The Bittensor price moved to the mid after a death cross developed a second time at 14:30 UTC.

Chart 1, TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, April 28, 2025

Several RSI overbought signals at 06:00 UTC and 12:30 UTC periods reflected brief periods of exhaustion in upward price movement. The appearance of a subsequent golden cross at 20:30 UTC offered TAO brief stability before selling pressure intensified because of a large MACD death cross. Bittensor price reached its lowest point near support at 02:30 UTC when the RSI displayed changed to oversold levels. The indicator served as the first indication of an upcoming market turnaround.

The TAO price received a rapid boost from the powerful golden crossover at 03:30 UTC. The price rose after a brief death cross at 05:00 UTC because bullish momentum carried it toward reaching the $365 resistance zone. The RSI moved into the overbought region as investors came into action. Bittensor demonstrated a defined price movement between support and resistance levels through well-defined golden and death cross patterns combined with key RSI levels that tracked buyer and seller activities from beginning to end.

What’s Next For TAO?

TAO exhibits intense volatility in today’s trading, with TAO Coin ranging between a support zone at $340 and a resistance at $365. Presently, the price is testing upper resistance, signaling significant bullish momentum. Several golden crosses on the MACD indicate possible upward movement, while sporadic death crosses send warning signals to short-term traders. RSI points out two overbought scenarios, which may indicate prices to pull back. Additionally, a recent oversold situation attracted buying interest. The TAO Price is powerful, and traders have Bittensor Price alerts on for any breakout and reversal signals within this active range.

TAO Coin Holds Range, Eyes Breakout:

The current price action of TAO is taking place between the bulls and the bears. The TAO coin has remained besieged between the $340 support and $365 resistance levels. Many golden and death crossovers appeared on the MACD along with the RSI’s overbought and oversold signals to provide good entry and exit opportunities. However, the price of Bittensor breaks resistance, and Bittensor is expected to embark upon a powerful bullish rally to breach all its former highs. However, moving below support would encourage bears to a trend reversal.

TAO Price Analysis of April 30th, 2025

The TAO price action began yesterday with a sudden bullish impulse, triggering a breakout near 04:10 UTC. The breakout action increased the price from $362.80 to its peak at $371.20 during the first minutes. The price experienced a temporary increase, which did not exceed the overbought threshold. At 05:30 UTC, a bullish trend activation appeared through the golden cross confirmation on MACD. The bullish momentum failed to continue after the breakout, so the rally rapidly weakened. The price entered a $368.00 consolidation zone through seller activity near the $374.00 resistance at 07:40 UTC.

Chart 2, TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, April 30, 2025

From 08:00 UTC to 12:00 UTC, TAO price maintained stable operations within the range of $366.00 to $370.00. The RSI stood steady in a neutral zone as various golden crosses developed on the MACD chart. The market failed to break through this tight price range even when volume increased occasionally. During the next part of the morning session, the price fell under increasing bearish influence, creating a series of declining peaks. The price turn emerged when a MACD death cross happened at 12:25 UTC, with the price falling below $371.00.

Persistent Downtrend Confirms TAO Structure

The price volatility spiked from 13:15 UTC to 21:00 UTC as the Bittensor price started moving inside a descending pattern. Sellers pushed the market value to $360.80 at 20:00 UTC. The Relative Strength Index entered oversold conditions several times, especially at 20:55 UTC and 21:15 UTC. The MACD indicator and death crosses remained consistently bearish, confirming the dominant negative momentum since the chart’s start. During this period, the market displayed brief price gains that never surpassed the $364.50 mark. The bearish structure became solid because the period indicated a continuous trend of declining highs and lows.

TAO maintained its position around the $358.00 support during the 3 hours starting at 21:00 UTC until 00:00 UTC. The oversold condition of RSI triggered a limited market uptick. A positive golden cross appeared on the MACD shortly before 22:30 UTC, although it failed to generate a substantial price increase.

TAO Price Outlook – What’s Next for Bittensor?

In the early hours of April 30, the TAO price hovered near the support zone of $357.50 and had a flat RSI between 36 and 48, which meant very weak momentum. MACD gave mixed signals, with short-lived golden crosses turning into death crosses, indicating indecision in the market. A minor bullish reaction around 04:20 UTC lifted the price to $362.30 but could not break above the descending trendline; sellers retook control and drove the price downward toward the lower support zone.

TAO Price Recovery in Doubt

Though Bittensor price has managed to avoid a drop below $359.0, the lack of a convincing rebound makes the outlook a little cautious. The TAO breakout above $370 failed as sellers quickly reversed gains, confirming a shift into a bearish channel. Buyers have come in at some critical support levels, while others offer strong overhead resistance near $364.80. A strong push above this level, with confirmation through a bullish MACD and RSI breach above 60, could leave the door open for a retest of $368.00. Declines below this support could make the next necessary support near $352.70, where further declines may elicit some sharp selling.

Bittensor (TAO) Price Analysis For May 2, 2025

The TAO Price began its session with steady growth, which formed an upward channel from 03:00 UTC until 09:00 UTC. Bullish momentum emerged after TAO rebounded from $351 support, triggered by an RSI bounce from oversold levels and a MACD golden cross at 05:25 UTC. The price reached the resistance area near $375 at 09:10 UTC during the rally that lasted until that time. The Bittensor price encountered prospective selling strength since the Relative Strength Index reached overbought levels during this period.

The upward trend reversed at 10:05 UTC because of a MACD death cross activating downward channel movement. The currency entered a descending downtrend pattern because sellers took control while the RSI moved back into bearish conditions from overbought territory. The price dropped rapidly during this period until it reached the $351 level at 13:25 UTC. At this time, both the RSI short-term indicators touched oversold levels while the MACD displayed multiple signals of death crosses indicating bearish market trends.

TAO Price Steady, Needs Break Above $360 for Upside Push

TAO Price stayed contained by the $352-$358 boundary from 14:00 UTC to 18:00 UTC. The recovery of the RSI signals buying pressure while a MACD golden cross formation emerged at 16:45 UTC. The Bittensor price stayed under short-term pressure because it did not surpass the downward channel’s upper boundary.

Chart 3- TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, May 2, 2025

TAO Coin failed to surpass $360 at 19:15 UTC, but the price quickly returned below its starting level. The market price of TAO has been holding a position around $357.4 as it maintains a brief spot above support levels. The technical indicators provide conflicting signals because the MACD stands still while the RSI is near the center. A bullish force will push prices above $360 to trigger a potential $375 resistance test, but failure at this level may lead to descending prices through $352.

Bittensor Shows Cautious Movement Near Critical Zones

TAO Coin began the day with steady growth, forming an ascending price channel between 03:00 and 09:00 UTC. A death cross appeared, which caused the Bittensor Price to reverse its overbought trend that started at 09:00 UTC. During noon, the TAO Coin price descended into a downward channel structure, which moved toward the $351 support level. Golden and death crosses appeared several times throughout the price action from 15:00 to 21:00 UTC, which indicated the market would experience drastic price movements. The TAO maintains stability at $357.4 at 07:25 UTC under conflicting technical indicators that suggest upcoming price volatility could be neutral.

TAO Price Rally Falters as Bears Defend Resistance

TAO had a clear path through different channels during the day, with an upward channel, while the termination point was around $352 support and at $375 resistance. Now, the Bittensor price is holding steady around $357, which seems indecisive for any trader. On the other hand, multiple MACD golden and death crosses happened throughout the day. The RSI has been oscillating between overbought and oversold areas, which is an indication of short-term swings. For the TAO Coin, there is a waiting market for robust drives that should propel breakouts from current patterns.

Traders might witness a bullish run once the price closes above the resistance. The contrary could open up doors for further declines triggered on the break below the given support level. All in all, the TAO price now enters a zone where traders must take special care when watching these levels, as the next move will likely set the tone for the near-term trend in Bittensor Price.

Bittensor (TAO) Price Analysis For May 6, 2025

In the last 24 hours, TAO has showcased solid price action and has gained bullish momentum. The TAO Price action has been mainly trend-based, with the coin moving consistently in the trading zone. The trading session begins with the TAO price being at $346. A golden crossover formed in the early hours of the session at 02:10 UTC that pushed the price with a bullish momentum to $360. The RSI responded quickly, going into the overbought region and validating a bearish reversal at 03:00 UTC. TAO soon began moving in an ascending momentum with minimal fluctuations in the flow. A major turn appears when RSI shows an oversold signal, causing the prices to fall. But, this action got retraced as a golden crossover appeared at 05:45 UTC.

Chart 4- TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, May 6, 2025

Bittensor soon hit the resistance level at $379 but failed to break the level. A sudden fall was observed right after the hit, as MACD indicates a death crossover at 06:25 UTC. This caused the prices to fluctuate again. The RSI momentarily showed overbought signals, indicating a bearish TAO breakout was on the cards. At 22:40 UTC, another resistance hit was observed, but again failed to breach the resistance level. The following fluctuations pulled the prices down to $370 by 23:25 UTC. The overbought RSI warranted a bearish trend, but a trading range followed instead as the bears persisted. The TAO breakout of the range seemed to be a bearish move, as the prices kept on fluctuating. However, it turned out to be a fakeout, as both bullish and bearish forces were in action. The prices fall to $374 by the end of the day.

TAO Coin Tests $379 Resistance – Will It Surpass?

Yesterday, the prices fell to $374. However, the trading session of today gave new hope to the buyers as the prices began to move upward again. The first resistance hit of the day was recorded at 05:00 UTC. However, with the RSI consistently working near the 70 level, a minor pullback to $379 was followed. The upward trend continued with a golden cross at 07:05 UTC, leading the price up to $372.

Around this point, the Bittensor prices seemed to be in a consolidation phase. But the death cross at 09:00 UTC finally lowered the price. The RSI also returned close to the midline for $366 at 09:55 UTC. Some fluctuations have followed, but TAO has never regained till now. However, the $379 resistance level has again rejected TAO’s advance movement for retracement.

TAO Price Stalls Amid Market Uncertainty

TAO price action represents a divided sentiment across the market. Given a confident start, buyers moved prices up strongly, but sellers acted swiftly as well, shutting down these bullish attempts near key resistance zones. With an element of hesitation coming with every bullish attempt, repeated failures in breaking resistance levels show that traders still prefer to remain cautious. This intense price action with a sharp recovery followed by a swift pullback indicates that uncertainty is still there. Until a clear trend takes center stage, two sides will still be waiting for a concrete signal before daring to make bold moves.

TAO Struggles at Resistance- What’s Next?

The TAO price showed an ongoing battle between bullish and bearish market influences. The coin demanded a strong start as golden crossover patterns indicated bullish dominance. The price rises encountered continuous opposition as the RSI checked overbought zones frequently before and after each upward movement. The TAO cryptocurrency faced a possible turning point upswing that couldn’t sustain beyond essential resistance points.

The price fell back into its trading range due to the death cross in combination with RSI readings that exhibited overbought conditions during the late session. Despite experiencing dips, TAO exhibited recovery, which halted the downward trend from becoming completely bearish. TAO faces an ongoing tug-of-war between bullish supporters and bearish opposition that will shape its future movements in the following hours.

Bittensor (TAO) Price Analysis of May 8, 2025

TAO opened yesterday with a bearish tone, slipping from the $387 zone after midnight. Before 03:00 UTC, the price moved steadily lower inside a defined downward channel, forming a consistent pattern. A MACD death cross at 01:45 UTC confirmed the weakness, and RSI marked a brief overbought signal before the decline progressed. From 03:00 to 08:00 UTC, selling pressure became aggressive. TAO price dropped from $387 to $360, with no significant bounce. A second death cross hit MACD around 05:15 UTC, while RSI plunged into oversold territory around 06:30 UTC. This set the stage for a possible reversal as the price moved towards the support level at $353, which held firm through previous sessions.

Chart 5- TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, May 8, 2025

The signs of recovery first appeared around 09:00 UTC as the price touched the bottom of the trading channel and moved near $357. A golden cross followed on MACD by 09:45 UTC, shifting momentum. RSI confirmed with a climb back above 30. From 10:00 to 13:00 UTC, Bittensor prices held above support and formed a higher lows pattern. This steady shift helped shape the beginning of a new upward channel. The move strengthened between 13:00 and 18:00 UTC as the price pushed from $362 to $377, staying within the upward structure.

Multiple overbought signals flashed on RSI, first at 15:20 UTC and again near 17:45 UTC, but dips were shallow. At 23:25 UTC, the pair broke out of the upward channel and cleared the major resistance level at $390. After 10 minutes, a strong candlestick carried the price above $395, signaling bulls had reversed the trend. Bittensor prices closed the day strong, holding around $398–$400 heading towards the next day.

TAO Breakout Holds Above $400 as Bulls Defend Gains

The TAO price continued its bullish momentum on May 8, consolidating above the $400 mark after yesterday’s TAO breakout. Early gains pushed Bittensor price to a $410 high by 02:30 UTC before a slight rejection. Despite brief consolidation, the structure remained intact, with buyers defending the $395–$398 zone. RSI cooled from overbought levels while MACD stayed flat, signaling balanced momentum. No significant breakdown occurred as the price ranged tightly throughout the day. With $390 now firm support, the TAO price holds bullish potential heading into May 9, especially if bulls reclaim the $410 resistance on renewed volume.

TAO Price Maintains Structure After Breakout as Bulls Hold Control

TAO price action today confirmed the bullish reversal initiated late yesterday. The strong move above $390 was sustained throughout today’s session, with the price consolidating above $400 for most of the day. Both RSI and MACD indicate balanced momentum, suggesting the market is stabilizing after the TAO breakout. The $390–$395 zone has now established itself as a firm support region. If this area continues to hold, the next resistance target sits at $415, with $410 being the immediate hurdle. A breakout above $410 on strong volume would likely extend the bullish leg. On the downside, any loss of $390 support could invalidate the breakout and lead to a short-term retracement. For now, however, bulls have the edge as long as price action stays within the current consolidation range. Traders should monitor volume and RSI closely as signs of the next move develop.

Bittensor (TAO) Price Analysis For May 12, 2025

The TAO price analysis over the last 24 hours shows a strong reversal pattern, starting from a steep decline in early morning hours and ending with a clean breakout above the $469 resistance level. The session began at midnight with TAO trading near $463, in a downward channel. By 03:00 UTC, selling pressure intensified, and the price steadily dropped from $463 to around $450, marking a lower low by early morning. Several MACD golden crosses formed throughout the day, notably around 01:15 UTC and 14:00 UTC, signaling bullish momentum. However, the early cross couldn’t hold, and a brief pullback followed. By 14:00 UTC, the golden cross provided a clearer signal of upward momentum, leading to the breakout later in the day. By 06:00 UTC, TAO moved toward the day’s bottom at $439.

Chart 6- TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, May 12, 2025

After the early decline, TAO found support at $439 and began stabilizing. This marked the beginning of a shift in momentum, setting the stage for the upcoming breakout phase. A fresh MACD golden cross around 08:45 UTC gave early signs of a potential reversal. The price bounced back to $448 by 10:00 UTC, but stayed in a sideways range between $445 and $455 until the early afternoon. At 13:30 UTC, momentum started building. A third MACD golden cross formed near 14:00 UTC, and the price began forming higher lows. By 15:30 UTC, TAO broke above the short-term range high at $455 and entered a clean upward channel, triggering steady buying.

TAO Holds Gains Near $475

Between 16:00 and 18:00 UTC, the TAO price rose from $439 to $463, marking a steady recovery phase before the breakout. The real shift came around 20:00 UTC, when the price crossed $469, breaking above the well-tested resistance. A clear TAO breakout followed between 21:00 and 23:00 UTC, with strong bullish candles driving the price as high as $482 by the end of the day. RSI touched overbought levels again around 22:30 UTC, while MACD maintained a positive crossover, confirming the bullish momentum was still intact. By 23:59 UTC, TAO had held above $475, confirming the reversal of $469 from resistance to short-term support.

TAO Price Consolidates Between $475 and $484 After Breakout Above $469

The TAO price today is showing signs of consolidation after its recent breakout above $469. Price is currently holding a narrow intraday range between $475 and $484, with early support forming around $475. The Bittensor price attempted to break above $485 but faced minor rejection near the upper channel. RSI is hovering near 58, showing a mild cooldown, while MACD remains above the signal line but with fading momentum. So far, the price structure remains neutral. A clean break above $485 could trigger a move toward $495, while failure to hold $475 may invite a retest of $469 support.

TAO Price Holds Steady After Breakout, Eyes Next Move Above $485

After clearing $469 resistance yesterday, the Bittensor price extended gains but now finds itself consolidating between $475 and $484. This sideways action is a positive, particularly following a strong upside move. The RSI has cooled from overbought, and the MACD is flattening, thus, buyers appear to be taking a break. Furthermore, price may stay above the former area of resistance, which is acting as support now. If bulls can maintain this zone, another leg up toward $495–$500 could be in play. A drop below $469 would weaken the current structure and suggest a deeper pullback. TAO remains bullish above $475, with the next resistance level at $485. If the TAO breakout can hold above $485, we could see it move towards $495–$500, but failure to hold $475 would indicate a move back down to retest $469.

Bittensor (TAO) Price Analysis For May 14, 2025

The TAO price analysis over the last 24 hours shows a choppy trading day with a breakout, consolidation, and multiple failed attempts to push past resistance. After moving in a downward channel early in the session, Bittensor price found support, but buyers struggled to sustain gains beyond $470.00.The price dipped near $452.00 in the early hours, as momentum flipped bearish with a MACD death cross and RSI dropping below 40. This downward move continued until around 03:00 UTC when buyers stepped in, triggering a short-term recovery. Between 03:00 and 07:00 UTC, the TAO price rebounded sharply.

Chart 7- TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, May 14, 2025

Around 11:00 UTC, the price found a solid support level at $450.00, holding multiple tests. At 12:30 UTC, TAO formed a clean breakout from its descending structure, reclaiming higher ground with momentum building again. TAO struggled to push past the resistance zone between $468.00 and $470.00. From 13:00 to 20:00 UTC, the price remained range-bound, repeatedly testing resistance without a breakout. Each attempt was met with quick rejection, leading to sideways action.

The TAO price continued to respect the $450.00 support and $470.00 resistance, trapping it in a tight range. By the end of the day, TAO was trading around $468.00, still under resistance. Momentum indicators looked flat, suggesting a cooldown. The overall structure now points to a TAO breakout scenario only if $470.00 is cleared convincingly. Until then, range-bound behavior may continue, with $450.00 remaining a key level to watch. If bulls manage a breakout above $470.00, the next short-term target could be $480.00. But if $450.00 fails, a drop toward $435.00 may follow.

TAO Price Holds Below $470 Resistance as Momentum Stalls

The TAO price analysis for today shows the market trading flat just below the $470 resistance level. After yesterday’s breakout attempt, the Bittensor price has struggled to gain upward momentum, with intraday action showing signs of exhaustion. The MACD is flattening after a golden cross, while RSI hovers around 60, suggesting a lack of strong buying pressure. The price remains supported near $450, forming a clear consolidation zone between key levels. Unless TAO breaks and closes above $470 with volume, upside may stay limited. A rejection could pull the price toward the $455–$450 support zone. The market remains range-bound, and traders are watching for a decisive TAO breakout in the next move.

Bittensor Price Loses Steam After Failed Breakout Attempt

In conclusion, the TAO price is moving in a tight range, with buyers showing hesitation near the $470 resistance. The recent upside momentum has cooled, and indicators like RSI and MACD suggest a neutral stance. The Bittensor price still holds above key support at $450, which keeps the short-term structure intact. However, without a strong breakout above $470, it’s unlikely that bulls will gain further control. A clear move above this resistance could open the door toward $480 and higher. Otherwise, if selling pressure increases and $450 breaks, TAO could slide to the $435 level. For now, the price is in wait-and-see mode, and the coming few sessions will be crucial to confirm the direction. Traders should watch for volume spikes near the $470 zone, which could hint at the next TAO breakout or rejection. Patience is key while momentum remains stalled.

Bittensor (TAO) Price Analysis For May 19, 2025

The TAO Price Analysis over the last 24 hours shows a clear mix of sideways action, quick surges, and sharp pullbacks across multiple trend channels. TAO started the day in a tight trading range between $413 and $418. Price moved sideways until 06:00 UTC, showing low volatility. A golden cross formed on the MACD, and the RSI started climbing, signaling early bullish momentum. This was followed by a minor spike into the overbought zone around 07:00 UTC. After that, TAO entered a downtrend from 07:00 to 09:00 UTC, dropping from $417 to $404. A death cross appeared on the MACD, while the RSI fell below 30, marking an oversold signal.

By 09:30 UTC, a strong bounce led TAO into an upward channel, pushing the price steadily from $404 to $440 by 13:00 UTC. This bullish leg became the day’s sharpest rally, showing strong short-term demand and creating a temporary TAO breakout above the earlier range. However, from 13:00 to 17:00 UTC, the Bittensor Price reversed inside a downward channel, giving up gains and falling to $412. RSI became neutral, and a death cross again hit the MACD, confirming selling pressure. The drop continued with a second downward channel, sending TAO as low as $394 by 18:30 UTC.

Chart 8- TAO/USDT M5 Chart, Analysed By Anushri Varshney, Published on TradingView, May 19, 2025

A bounce came around 19:00 UTC, starting another upward channel. The price rose from $394 to $426 by 21:30 UTC, again supported by a fresh golden cross and an RSI near 70. Yet, this recovery was short-lived. From 22:00 UTC, TAO price fell into its third downward channel, steadily losing value into the night.

TAO Price Sees Weak Bounce After Heavy Decline

Today, the Bittensor price showed limited recovery after a sharp drop overnight. Starting near $399, the price hovered sideways before forming a weak bounce from the $390 zone around 07:00 UTC. This move followed an RSI oversold reading and a golden cross on MACD. Despite that, the bounce lacked volume and failed to break above $401. The broader trend remains within a downward channel, with sellers still in control. Multiple deaths cross earlier reinforced bearish sentiment. Unless TAO reclaims $410, upside remains capped. The Bittensor price is struggling to maintain the momentum, and no clear TAO breakout has developed. Immediate support lies at $390.

TAO Price Holds Near $400, But Momentum Remains Weak

The TAO Price is currently holding just under the $400 mark after facing strong selling pressure throughout the previous sessions. Price action shows a clear series of downward channels only briefly interrupted by weak recoveries. Although the RSI has triggered multiple oversold signals and the MACD has shown a few golden crosses, none of these signs have translated into a strong reversal.

Every bounce was short-lived, and the broader trend continues to lean bearish. The lack of a sustained TAO breakout above $410 keeps bulls on the sidelines. For now, the Bittensor Price remains in a consolidation phase below key resistance levels. If the $390 support breaks, further downside could follow. Any recovery above $410 would be the first step toward shifting momentum back in favor of buyers.

Bittensor (TAO) Price Analysis For May 22, 2025

The TAO price action today shows a clean mix of steady rallies, pullbacks, and a strong breakout in the final stretch. The day began with a strong push from buyers. Between 00:00 and 00:50 UTC, the Bittensor price climbed inside a steep upward channel, moving from $454 to $466. A golden cross on the MACD and a rising RSI helped push momentum upward. By 01:00 UTC, the pair moved into a short trading range, hovering between $465 and $470. This sideways action lasted till around 01:40 UTC. During this time, the RSI entered overbought territory, and a death cross on the MACD appeared at 01:25 UTC, warning of possible weakness.

The price then dropped slightly to retest the $462 zone. From 01:50 to 03:00 UTC, the TAO price slowly regained strength, a steady uptrend formed again, supported by another golden cross around 02:00 UTC. The price bounced between $462 and $469, following an upward channel formation. Momentum remained firm as the RSI hovered near 60, with no extreme signals.

Chart 9- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, May 22, 2025

Between 03:15 and 04:00 UTC, the bullish trend continued. TAO stayed inside another clean upward channel, lifting from $466 to $472. The MACD showed another golden cross, while the RSI touched overbought levels again, signaling a temporary peak. By 04:10 UTC, a death cross confirmed slowing momentum. After 04:15 UTC, the Bittensor price started slipping. A visible downward channel formed, and the price pulled back steadily from $472 to a low of $460 by 05:30 UTC. The RSI moved closer to oversold, and the MACD stayed bearish with red histogram bars growing stronger.

TAO Breaks Out Above $470 After $460 Rebound, Targets $476 Next

At 05:55 UTC, the market flipped again. A final golden cross appeared, and the TAO price bounced sharply from $460, breaking out of the descending channel. This TAO breakout pushed the price straight to $472 by 06:30 UTC. The RSI spiked past 70 again, confirming strength but hinting at near-term exhaustion. As of 06:48 UTC, the TAO price trades at $472.8 with mild intraday gains. Buyers regained control after mid-session weakness, and the breakout suggests continuation is likely if $470 holds as support. The TAO breakout above $470 confirms bullish pressure is intact. Watch for $476 as resistance, with $460 now strong support.

Strong Recovery and Breakout Signal Bullish Momentum

The TAO price ended the session on a strong note after reclaiming its bullish structure late in the day. While the Bittensor price faced mid-session selling pressure and dropped into a downward channel, buyers stepped back in near $460 and triggered a clean TAO breakout above $470. Momentum picked up sharply with a golden cross on the MACD and an RSI bounce from oversold levels, confirming buyer control. The breakout erased earlier losses and placed the TAO price back near the day’s high.

If $470 continues to act as support, bulls may push for a test of the $476 resistance next. On the downside, $460 remains key to holding the structure. The overall setup shows strength returning to the market after a brief pause. With price back above key levels and momentum indicators favoring bulls, the TAO breakout could lead to more upside in the short term.

TAO Price Analysis For May 24, 2025

The TAO Price analysis over the last 24 hours shows a clean structure of breakouts, trend shifts, and channel formations. Early signs of momentum built up after midnight, followed by a steady series of MACD and RSI confirmations throughout the day. The session began around 00:00 UTC with sideways movement under resistance. At 00:30, a clear TAO Breakout occurred, pushing above short-term consolidation. The MACD at this stage turned bullish while RSI briefly entered overbought territory. That early push set the stage for a structured uptrend.

Between 01:00 and 03:30 UTC, the Bittensor Price moved inside a well-formed upward channel. Higher lows and rising support guided the move. The MACD printed a golden cross at 02:00 UTC, followed by another strong signal at 03:30 UTC, supporting the upward momentum. The trend reversed slightly after 04:00 UTC. A gradual breakdown from the channel turned into a proper downward channel by 04:30 UTC.

Chart 10- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, May 24, 2025

This marked the first bearish shift of the day. Between 04:00 and 06:00 UTC, the MACD gave multiple death crosses, showing clear exhaustion in buying pressure. The RSI touched oversold levels near 05:30 UTC, aligning with the MACD’s signal. By 06:15 UTC, another TAO Breakout reversed the prior drop. The chart broke out of the downward channel and formed a fresh short-term uptrend. This move aligned with a golden cross on the MACD and a bounce in RSI from oversold to overbought. That breakout led to a clear bullish shift for the second half of the session.

TAO Price Eyes $434 as Momentum Cools Near Resistance

From 07:00 to 08:00 UTC, the price formed a steady climb, with two more golden crosses on the MACD adding strength to the rally. RSI again entered overbought around 08:15 UTC, hinting at a temporary top. The final hour between 08:00 and 09:00 UTC showed consolidation near $432, with a mild pullback due to a death cross in the MACD.

The Bittensor Price traded within technical channels most of the day, and momentum indicators supported bullish and bearish turns. As long as support near $428 holds, short-term sentiment remains positive. However, overbought signals and MACD cooling off suggest some near-term caution. Watch for a sustained close above $434 to confirm the next leg of upside.

TAO Price Holds Gains After Channel Breakouts and Momentum Shifts

The TAO Price successfully closed the session after navigating a full day of breakouts, channel formations, and momentum swings. The early breakout above resistance confirmed bullish intent, which was followed by a clean upward channel supported by golden crosses on the MACD. A mid-session pullback led to a downward channel, but the RSI touched oversold, and another TAO breakout around 06:00 UTC sparked a recovery. Momentum picked up again with multiple golden crosses and a rising RSI, showing buyers remained active. However, late-session overbought conditions and a death cross hint at short-term cooling.

Overall, the Bittensor Price held higher lows, which keeps the broader structure intact. If bulls push above the $434 resistance level with volume, the uptrend could continue. On the downside, support near $428 must hold to prevent a deeper correction. The chart structure still favors bulls, but upcoming sessions may bring short-term consolidation.

Bittensor (TAO) Price Analysis For May 26, 2025

The TAO price analysis showcased a steady climb through multiple uptrends, a brief trading range, and a breakout above $460 before pulling back toward $450. The Bittensor price action remained bullish for most of the session, but signs of short-term exhaustion are now visible as sellers took over late in the day. The day started with a clear uptrend, forming an upward channel from around $432 at 00:10 UTC. Price climbed steadily, pushing toward $446 by 01:45 UTC. This move was supported by MACD golden crosses and RSI reaching overbought, showing strong bullish momentum and buyer confidence early on.

Following the first upside leg, the price of TAO traded sideways between 01:50 and 03:15 UTC, between $445 – $448. During this time, the MACD flattened, while the RSI slipped for a minute into oversold territory, implying a short-term cool-off. This consolidation allowed bulls to regain strength. At 03:20 UTC, the Bittensor price broke out of the range with another uptrend, re-entering an upward channel. Price climbed from $445 to nearly $458 by 05:00 UTC. RSI again pushed into overbought zones, while the MACD flashed another golden cross, indicating renewed bullish control.

Chart 11- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, May 26, 2025

TAO Breakout Hits $464 Then Drops Below $452 by 06:20

Around 05:10 UTC, a short downtrend emerged within the channel, with the price dipping toward $450. But that was followed by a strong TAO breakout at 06:00 UTC, where the price spiked past $464, hitting a new local high. The RSI hit another peak, and the MACD momentum surged. This was the strongest bullish move of the session, confirming breakout strength after hours of buildup. However, the breakout was short-lived. Sellers stepped in by 06:20 UTC, and the price pulled back below $452. A MACD death cross followed around 06:45 UTC, signaling weakening momentum. The RSI also dropped fast, falling into oversold levels by 07:15 UTC.

TAO Price Faces Key Retest After Breakout Pullback

The TAO price is approaching a critical zone after a strong breakout attempt above $460 failed to hold. While the Bittensor price showed impressive strength throughout the session with consistent uptrends and bullish momentum, the recent rejection near the highs has brought a shift in sentiment. The RSI has cooled off from overbought levels, and the MACD has confirmed a death cross, both pointing to weakening short-term momentum. If bulls can defend the $444–$448 support area, there’s still room for recovery and a stronger TAO breakout attempt in the next session. However, a breakdown below $444 could drag the Bittensor price closer to $440 or lower, testing previous demand zones.

Overall, the current market structure suggests consolidation, with the TAO price caught between fading bullish pressure and buyers looking for fresh entry points. The next move will likely depend on how the price reacts at the lower trendline in the coming sessions. Traders should watch how TAO reacts near $444—holding it could open the door for the next TAO breakout above $460.

Bittensor (TAO) Price Analysis For June 1, 2025

The TAO price analysis shows a mix of steep pullbacks and quick recoveries. The price moved inside clear channels and responded strongly to both MACD signals and RSI levels. Traders saw multiple TAO breakouts, but the overall bias stayed slightly bearish as the Bittensor price closed near its intraday low.

The move began around midnight UTC with TAO trading near $444. From 00:00 to 01:30 UTC, the price dropped inside a downward channel. This move was supported by a death cross on the MACD and an RSI drop toward oversold. TAO slipped from $444 to $432 by the end of this stretch. Between 01:30 and 02:30 UTC, another downward channel formed. The price fell further from $432 to $426.

Chart 12- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, June 1, 2025

The Bittensor price remained under pressure until a TAO breakout finally appeared. At 02:30 UTC, TAO reversed direction and formed a sharp uptrend. A golden cross on the MACD triggered a rally from $426 to $442 over the next 90 minutes. This recovery created an upward channel, and the RSI entered overbought by 04:30 UTC. The TAO price faced rejection at this point and began pulling back.

TAO Slips from $442 to $416 in 4 Hours Despite 3 Golden Crosses

Between 05:00 and 06:30 UTC, another downward channel took shape. Price dropped from $442 to $430 as a death cross reappeared on the MACD. A golden cross did show up briefly at 06:00 UTC but failed to carry the momentum. From 07:00 to 08:30 UTC, the price drifted lower inside another bearish channel. TAO hit $426 again and showed weak attempts to bounce.

A golden cross near 08:00 UTC pushed the price slightly up, but it didn’t last. By 09:30 UTC, the Bittensor price had reached the day’s low near $416. The last pull of the day saw TAO forming a tight range between $416 and $420. An RSI oversold reading around 09:45 UTC helped stabilize the drop. A final golden cross on the MACD appeared by 10:00 UTC. TAO ended the session near $419 with small candles and reduced volume.

TAO Breakout Attempts Face Resistance Amid Weak Momentum

Despite several short rallies, the TAO price struggled to maintain any lasting upside today. Each TAO breakout attempt was followed by strong resistance, often triggered by overbought RSI levels or MACD death crosses. The Bittensor price formed multiple downward channels throughout the day, keeping sentiment cautious. TAO found temporary support near $416 after touching oversold RSI levels twice, which helped prevent deeper losses. However, the price failed to reclaim the $422 zone, signaling hesitation from buyers. Momentum indicators improved slightly in the final hour with a golden cross, but volume remained low. For bulls to regain control, the TAO price must break and hold above $422 to open the door for a move toward $428–$432. On the downside, a fall below $416 could drag the Bittensor price toward $410. Until a clean breakout confirms direction, TAO may continue to trade within a narrow range.

Bittensor (TAO) Price Analysis For June 7, 2025

The TAO price analysis shows a clear cycle of bullish movement, short-term correction, and sideways consolidation. The day began with the Bittensor price holding steady near $366.00 during early low-volume hours. By 00:30 UTC, the price started rising inside an upward channel, breaking above $368.50 with strong momentum. Between 01:00 and 01:45 UTC, the bullish trend continued as TAO moved above $371.50. A brief pause followed, but another upward channel formed by 02:10 UTC, lifting the price further toward $376.00.

RSI once again entered the overbought zone, and two more golden crosses on the MACD signaled continued buying interest. By 03:50 UTC, the TAO price began to reverse. A MACD death cross confirmed weakening momentum, and a new downward channel pulled the price from $376 down to $370. RSI dropped sharply, briefly touching oversold levels around 04:30 UTC, which marked the local low.

Chart 13- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, June 7, 2025

A recovery followed at 05:15 UTC as the bittensor price broke out of the descending channel. This TAO breakout pushed the price back above $374, backed by a clean golden cross on the MACD and RSI bouncing back above 50. The breakout carried momentum for another 30 minutes, retesting $375.80 by 06:00 UTC.

TAO Price Consolidates Between $372 and $376 After Breakout Rally Stalls

From 06:30 UTC onward, the price moved sideways between $372.00 and $376.00. The trading range lasted for several hours, with the MACD flipping between golden and death crosses, showing reduced momentum. RSI also stayed in a tight band between 50 and 60, signaling indecision.

Between 08:00 and 09:00 UTC, TAO price tested both boundaries of the range but failed to break out. Another brief overbought RSI reading occurred near 08:30 UTC, but it faded quickly. By 09:30 UTC, the price stabilized near $374.50, and the MACD flattened out with the signal line, confirming a neutral trend. The session closed with TAO holding above key support at $374.00, but lacking the momentum for a fresh breakout.

TAO Price Remains Neutral as Buyers Await Break Above $376

The TAO price closed the session in a neutral zone, trading just above the $374.00 support after failing to extend its earlier breakout. While the bullish rally during early hours showed strength, the momentum faded as the price entered a prolonged sideways range between $372.00 and $376.00. Key indicators such as the MACD showed multiple golden and death crosses, highlighting market indecision. RSI was also neutral, not confirming a strong uptrend nor encouraging short-sellers to believe bearish weakness is developing.

The price was unable to break through the $376.00 resistance, indicating that buyers are not eager to buy just yet, waiting for confirmation of a breakout above this level. Price action also hasn’t looked at support at $372.00, providing bulls with some cushion. Until we get some clear directional movement either way, the Bittensor price will likely remain in consolidation. A successful close above $376.00 could open the door for a renewed TAO breakout toward the $380.00 zone.

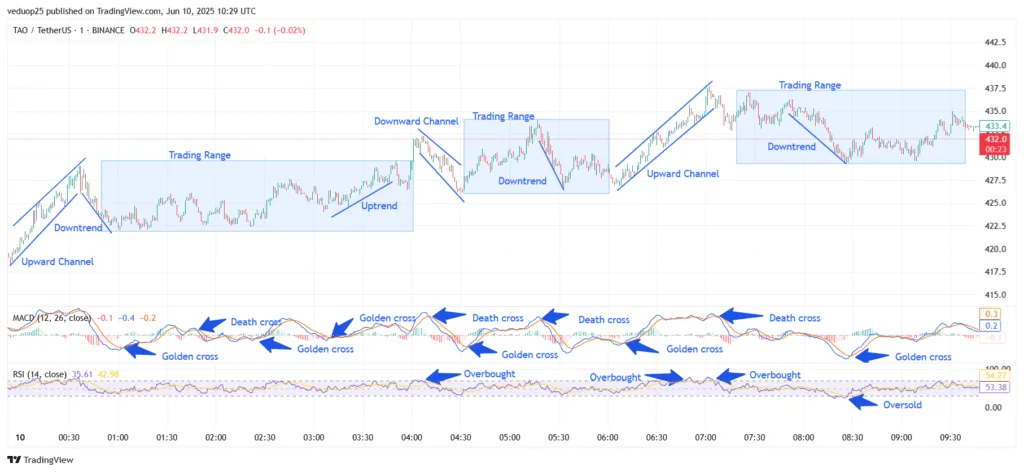

Bittensor (TAO) Price Analysis June 10, 2025

The TAO price analysis highlights a clear cycle of bullish movement, short-term correction, and sideways consolidation. The day began with the Bittensor Price holding steady near $366.00 during early low-volume hours. By 00:30 UTC, the price started rising inside an upward channel, breaking above $368.50 with strong momentum. Between 01:00 and 01:45 UTC, the bullish trend continued as TAO moved above $371.50. A brief pause followed, but another upward channel formed by 02:10 UTC, lifting the price further toward $376.00.

RSI once again entered the overbought zone, and two more golden crosses on the MACD signaled continued buying interest. This phase marked the peak of the upward move. By 03:50 UTC, the TAO price began to reverse. A MACD death cross confirmed weakening momentum, and a new downward channel pulled the price from $376 down to $370. RSI dropped sharply, briefly touching oversold levels around 04:30 UTC, which marked the local low.

Chart 14- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, June 10, 2025

A recovery followed at 05:15 UTC as the Bittensor Price broke out of the descending channel. This TAO breakout pushed the price back above $374, backed by a clean golden cross on the MACD and RSI bouncing back above 50. The breakout carried momentum for another 30 minutes, retesting $375.80 by 06:00 UTC.

TAO Price Consolidates Between $372 and $376 After Breakout

After that, TAO entered a consolidation phase. From 06:30 UTC onward, the price moved sideways between $372.00 and $376.00. The trading range lasted for several hours, with the MACD flipping between golden and death crosses, showing reduced momentum. RSI also stayed in a tight band between 50 and 60, signaling indecision.

Between 08:00 and 09:00 UTC, TAO price tested both boundaries of the range but failed to break out. Another brief overbought RSI reading occurred near 08:30 UTC, but it faded quickly. By 09:30 UTC, the price stabilized near $374.50, and the MACD flattened out with the signal line, confirming a neutral trend. The session closed with TAO holding above key support at $374.00, but lacking the momentum for a fresh breakout. The structure suggests buyers are waiting for confirmation above $376 to re-enter strongly.

TAO Price Remains Neutral as Buyers Await Break Above $376

The TAO price closed the session in a neutral zone, trading just above the $374.00 support after failing to extend its earlier breakout. While the bullish rally during early hours showed strength, the momentum faded as the price entered a prolonged sideways range between $372.00 and $376.00. Key indicators such as the MACD showed multiple golden and death crosses, highlighting market indecision. RSI also stayed range-bound, neither confirming a strong uptrend nor hinting at bearish weakness.

The inability to push past the $376.00 resistance suggests that buyers are currently hesitant, waiting for a confirmed breakout above this level. On the downside, support at $372.00 remains intact, providing a safety net for bulls. Until a clear directional move emerges, the Bittensor price is likely to stay in consolidation. A successful close above $376.00 could open the door for a renewed TAO breakout toward the $380.00 zone.

Bittensor (TAO) Price Analysis For June 13, 2025

The TAO price analysis shows a highly volatile cycle, shaped by two sharp reversals, a steady trading range, and multiple breakout phases. The session opened with strong selling pressure. At 01:15 UTC, the Bittensor price dropped sharply from $383 to $354 inside a steep downward channel. RSI touched oversold near 00:45 UTC, and MACD stayed bearish with no signs of recovery.

At 01:30 UTC, TAO formed a small base and began moving upward. Between 01:30 and 03:30 UTC, prices climbed steadily from $354 to $368 inside an upward channel. This was supported by multiple golden crosses on MACD near 02:00 and 02:45 UTC. RSI moved above 50 and held there, confirming the momentum shift. This segment marked the first TAO Breakout of the day, as bulls gained clear control after an oversold bounce.

Chart 15- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, June 13, 2025

From 03:45 to 05:45 UTC, the price entered a sideways range between $366 and $370. RSI hovered between 50 and 60, and MACD showed a golden cross at 04:30 UTC. However, the price failed to make a breakout. The TAO price remained flat, signaling exhaustion in the uptrend. A trading box formed and lasted until the next strong move.

Sharp TAO Breakout Fizzles as Price Slips into Downward Channel

A sudden drop came at 06:00 UTC. The price fell sharply from $366 to $352 by 06:15 UTC. RSI touched oversold again, and a clean death cross appeared on MACD. But right after, the bulls returned. From 06:30 to 08:00 UTC, TAO entered a strong upward channel. Price surged from $352 to $376, marking the second major TAO breakout. RSI moved above 70, and MACD showed fresh golden crosses at 06:45 and 07:30 UTC.

After peaking, the TAO price began a slow correction. From 08:15 to 09:30 UTC, the price moved sideways near $374, but by 09:45 UTC, a downward channel had started forming. MACD flipped into a death cross at 09:30 UTC, and RSI dipped below 50, confirming bearish pressure. Between 10:00 and 10:30 UTC, the price dropped to $364. A minor bounce followed, but no breakout was seen. By the final candle, Bittensor Price hovered near $367, showing a slight recovery inside the downward channel.

TAO Faces Mixed Momentum After Dual Breakouts

The TAO chart highlighted a mix of strong breakouts and corrective phases. The first TAO breakout from $354 to $368 came after an early oversold dip, backed by golden crosses and a rising RSI. This was followed by a flat trading range where the bittensor price failed to push higher. The second TAO breakout from $352 to $376 was sharper and cleaner, with strong MACD support and RSI hitting the overbought zone. However, both uptrends were eventually met with steady profit booking.

The final hours saw a slow drop inside a downward channel, pulling the TAO price back to $364 before a small bounce near the close. Indicators remain mixed, with MACD showing instability and RSI stuck near the midline. Until the price breaks above $376 or drops below $352, the bias stays neutral. Short-term traders should watch for breakout signals in the coming hours.

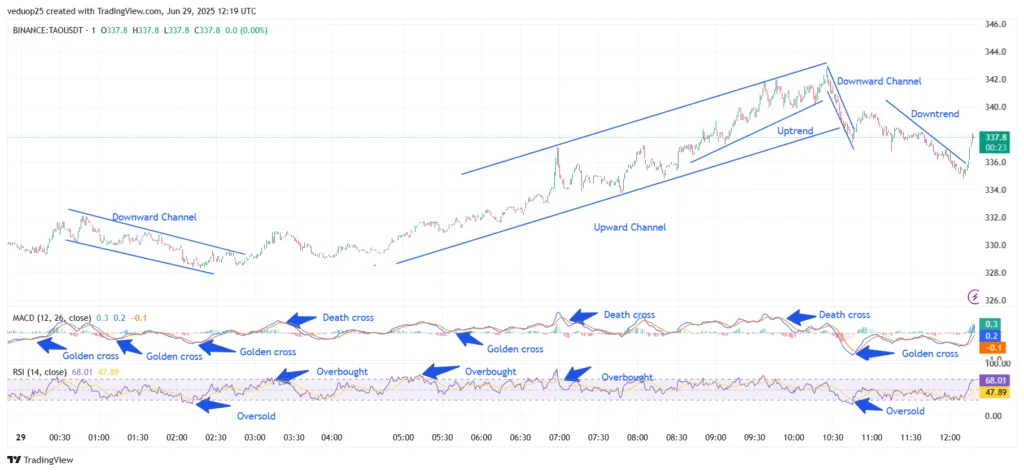

Bittensor (TAO) Price Analysis For June 29, 2025

The TAO price analysis shows a clear mix of trend shifts, momentum changes, and key breakout moments. Bittensor price started the day consolidating around $330, with low volatility and tight movement. By 02:30 UTC, the pair moved inside a downward channel, gradually falling from $330.8 to $328.2. During this move, RSI stayed neutral but dipped into oversold levels near 02:40 UTC, signaling weakness. MACD formed two golden crosses before 03:00 UTC, suggesting early signs of a recovery.

Chart 15- TAO/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, June 29, 2025

Between 03:00 and 05:00 UTC, the TAO price stabilized and started shifting higher. Another golden cross on the MACD supported this move, and the price slowly climbed above $330. Around 05:15 UTC, the breakout began. TAO broke above resistance and entered a strong upward channel. This TAO breakout lifted the price steadily from $331 to $341 by 07:15 UTC. The structure was clean, with higher highs and lows confirming the uptrend.

TAO Price Drops from $342 to $334, Recovers to $337.8

At 07:30 UTC, momentum slowed. MACD showed a death cross at the top near $342, marking the end of the rally. TAO then dropped into a new downward channel from 07:45 to 09:00 UTC. The price pulled back sharply from $342 to $336. RSI moved down to neutral. This downtrend continued past 09:30 UTC and extended further between 10:00 and 11:00 UTC, with TAO price touching a session low near $334. MACD formed another death cross, confirming the bearish stretch, and RSI dropped again into the oversold zone at 11:15 UTC.

By 11:30 UTC, TAO showed signs of recovery. A golden cross formed on MACD around 11:45 UTC, and RSI bounced back above 47. The price reacted quickly and jumped from $334 to $337.8 by noon. While not a strong TAO breakout, the bounce off $334 highlighted buyer interest and key support holding firm. The TAO price moved within a wide range of $328 to $342. Golden and death crosses guided intraday reversals well, while RSI offered solid overbought and oversold confirmation.

TAO Price Finds Support After Pullback, Eyes Recovery

TAO price rebounded after mid-session selling, recovering from a $342 high to a $334 low before regaining strength. Despite falling from the $342 peak to a low near $334, the Bittensor price held support well, triggering a bounce in the final hour. This bounce followed a MACD golden cross and RSI rising above 47, signaling renewed bullish momentum. While no major TAO breakout occurred in the closing hours, the price reclaiming $337.8 suggests buyers are stepping back in. If momentum continues, a push above $338 could confirm a fresh breakout attempt.

If buyers hold above $334, a breakout above $342 could trigger the next move. TAO price remains in focus with early signs of renewed upside strength in the Bittensor price trend. With strong intraday reactions and momentum signals aligning, TAO price may attempt a fresh move above $342 if support holds.