Theta Network is a decentralized blockchain platform designed to power next-generation video streaming, AI infrastructure, and media delivery. Built with a dual-token system and a unique proof-of-stake consensus model, it enables efficient data sharing while reducing costs for content platforms. Fundamental to the Theta protocol is decentralization, scalability, and real-time utility driven by tools such as Enterprise Validator Nodes and edge nodes. Through collaborations with large tech companies such as Google and Samsung, the Theta token also takes a central role in securing the network as well as rewarding participants. As the ecosystem grows, so does interest in the Theta price.

THETA Price Analysis For August 1, 2025

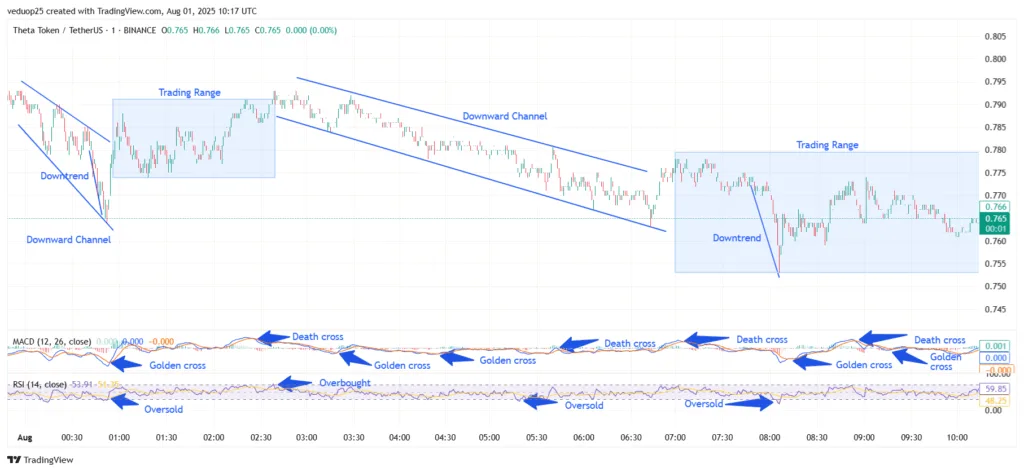

The THETA price analysis shows a clear structure of repeated downtrends, short-lived recoveries, and consistent resistance near $0.78. The day opened near the $0.78 mark but quickly slipped into a sharp downtrend from 00:00 to 00:45, forming a downward channel as sellers pushed the theta price down to around $0.765. The price attempted a brief rebound but remained confined to a sideways range between 00:50 and 02:20.

A golden cross appeared around 01:15, but its impact was short-lived. The price lacked bullish momentum and stayed capped under resistance. From 02:30 onward, another death cross triggered a deeper drop. This new downward channel ran until about 06:30. Within this stretch, the theta price declined steadily from $0.775 to near $0.760, respecting the upper and lower trendlines.

Chart 1- THETA/USDT M1 Chart, Analysed By Anushri Varshney, Published on TradingView, August 1, 2025

RSI stayed mostly below 50, confirming continued bearish pressure. Around 07:00, a quick selloff occurred, forming a steep downtrend that bottomed near $0.755. The RSI again dipped into oversold territory. A weak recovery followed between 07:30 and 08:00, but the price again moved into a horizontal range near $0.765–$0.775.

During the final hours, the protocol showed signs of stabilization, with RSI recovering above 50 and MACD lines crossing bullishly again. However, buyers failed to push past the $0.775 ceiling, and the token traded sideways until the close. Another death cross appeared after 09:45, signaling a weak close and lack of bullish confirmation.

Theta Network Partners with Crypto.com to Boost Institutional Adoption and Security

Theta Network has announced a strategic partnership with Crypto.com, appointing the exchange as its official U.S. custody provider. As part of the collaboration, Crypto.com will custody 15 million THETA tokens, which have now been restaked into an Enterprise Validator Node. Crypto.com’s inclusion, backed by SOC-2 Type II-certified infrastructure, adds regulatory strength and security assurance to the Theta protocol.

With the restaked tokens now securing the network, it strengthens its Byzantine Fault Tolerant (BFT) consensus layer, already powered by nodes from firms like Google and Samsung. This collaboration also hints at passive income potential for token holders, as staking rewards may improve in value. While Theta’s token remains far below its all-time high, the long-term outlook has turned more optimistic. Some in the community view this as a turning point for the token price and its role in Web3 ecosystems like NFTs and DeFi.

Theta Price Outlook Following Strategic Custody Partnership

The collaboration between Theta Network and Crypto.com could be an indicator of a stable and brighter future for the Theta price, especially as institutional adoption becomes deeper. This is in tandem with the vision of the Theta protocol to enable enterprise-grade blockchain infrastructure for AI, media, and entertainment.

Crypto.com’s position as a U.S. custodian not only enhances regulatory adherence but also instills investor trust through its SOC-2 Type II-certified infrastructure. On a market basis, higher validator participation and better staking systems may generate long-term demand and could push the Theta price higher. Although short-term fluctuations persist, particularly considering Theta’s precipitous decline from all-time highs, the restaking event provides additional staking opportunities that might appeal to passive income hunters. As long as momentum endures, the Theta token can see gradual appreciation as the ecosystem grows.