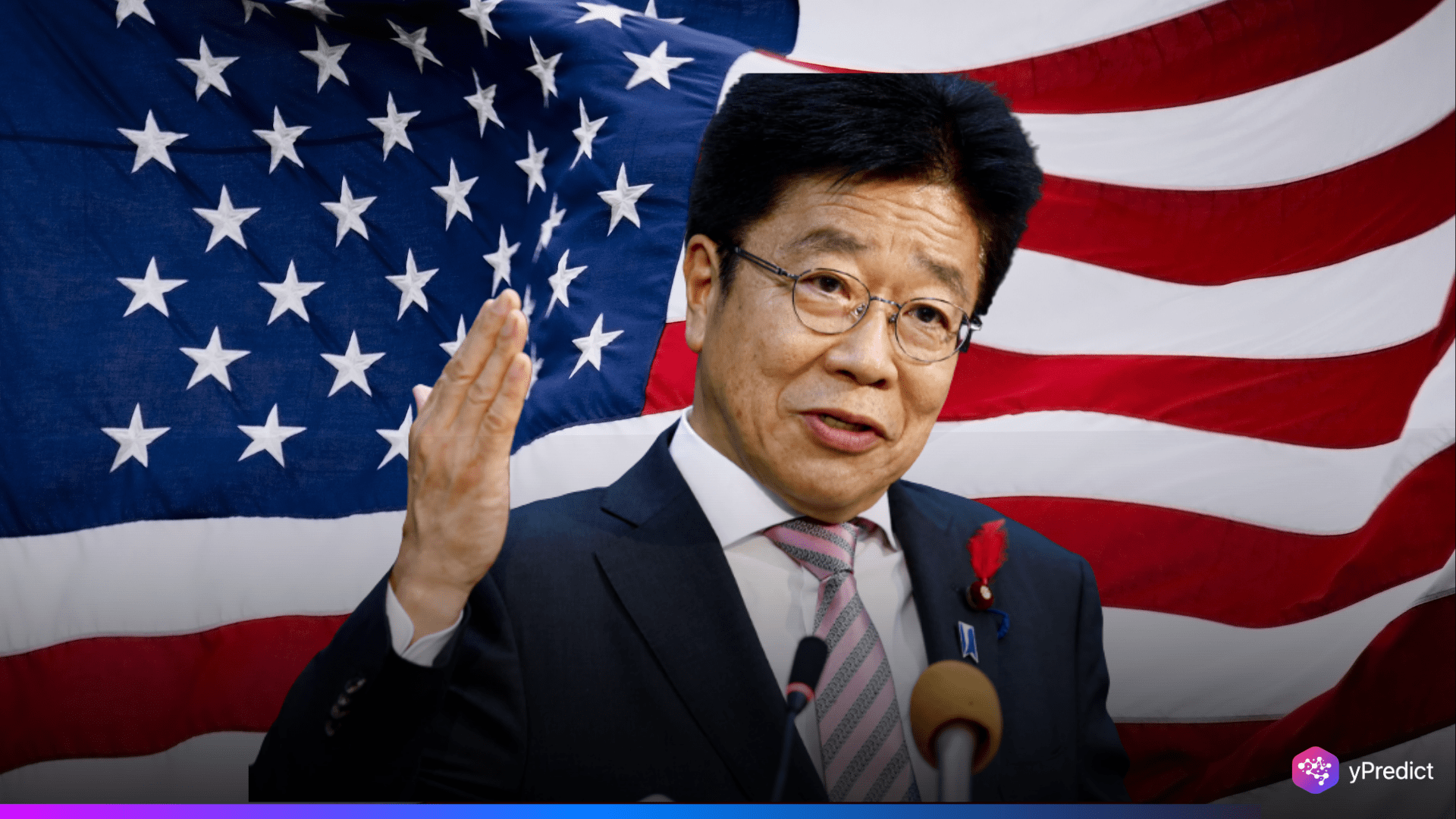

Japanese Finance Minister Katsunobu Kato and US Treasury Secretary Scott Bessent met in Washington this week to reassert their belief in market-determined exchange rates. The leaders evaded talking about direct intervention or yen-specific policies despite increasing fears about the currency’s recent volatility. With rising trade tensions around the world, Japan complained about recent US tariffs, but both sides had a conciliatory tone.

A Strategic Shift Without Currency Fixes

According to Reuters, Japanese Finance Minister Katsunobu Kato announced on Thursday that he and U.S. Treasury Secretary Scott Bessent had committed to maintaining a “constructive” dialogue on matters related to currency policy. However, the discussion did not extend to establishing specific currency targets or mechanisms to manage fluctuations in the yen.

During their inaugural in-person meeting in Washington earlier the same day, Kato provided Bessent with an overview of Japan’s current economic landscape, highlighting recent wage growth as a key development.

The meeting took place alongside the IMF and World Bank sessions. Kato presented a review of Japan’s recent economic growth, focusing on growing wage levels. Both parties emphasized the G7’s unanimous support for market-determined currency rates. They also noted that increased volatility in currency markets threatens overall economic stability.

However, Kato noted that no talks were held about currency rate targets, intervention measures, or criticism of the yen’s recent decline. He claimed that there was no US pressure on Japan’s currency policies. Bloomberg reported that Kato told the reporters that,

“There was no talk from the US at all about target levels for exchange rates, or a framework to manage currencies,”.

However, Kato and his counterpart affirmed their commitment to maintaining close dialogue on currency matters as part of the broader, ongoing bilateral trade discussions.

Strategic Patience as Dialogue Continues

Kato refused to say anything about next steps or the potential effects of the talks on wider US trade negotiations. According to reports, Japanese policymakers are cautious to intervene in currency markets or hike interest rates in the short term. After plunging to a 29-year bottom in July 2024, the yen has since recovered to roughly 142 per dollar, owing mostly to a weaker US currency.

Policymakers are concerned about further yen appreciation, which might harm exporters already pressured by US tariffs. Speaking on Wednesday, Bessent underlined that the United States does not want to set precise currency targets, instead relying on tariffs, non-tariff obstacles, and subsidies. He also urged Japan to respect its G7 currency rate agreements.

Tokyo shares rose after Kato’s comments, with the Nikkei 225 gaining 1.9%. Both sides stressed that exchange rates must be determined by the marketplace and warned against destabilizing shifts. They promised to continue open communication about financial matters. During the G20 conference, Bank of Japan Governor Kazuo Ueda stated that interest rate increases will be modest. He emphasized that any policy changes would be dependent on whether economic data remained consistent with the central bank’s predictions. He said in a statement:

“We will carefully and appropriately monitor the data and make policy decisions accordingly. We will of course, pay particular attention to data related to the mechanisms through which tariffs may have an impact.”

The Japan Times reports that Ryosei Akazawa, Japan’s senior trade negotiator, met with US officials in Washington to begin formal negotiations. Akazawa will return to Washington next Wednesday as both nations edge closer to a preliminary trade framework that could lead to broader negotiations and a future agreement.