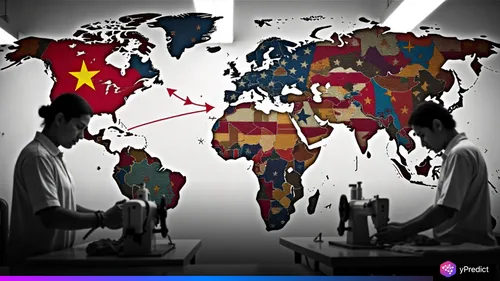

India’s textile exports are entering a period of significant uncertainty as major manufacturers reassess their production strategies for the US market. With an annual textile export value of over ₹87,000 crore to the United States, industry leaders are making quick decisions to safeguard profitability and customer relationships. The newly imposed 50% tariff on Indian textiles has triggered a strategic pivot toward more tariff-friendly nations.

Many Indian firms, including Pearl Global Industries, are turning their US orders to their offshore facilities in countries like Vietnam, Indonesia, Bangladesh and Guatemala, which are under more favorable tariff structures and allow exporters to stay competitive, even as policies continue to shift. This effort doesn’t mean abandoning India or Indian manufacturing; it is to safeguard an important revenue stream while expanding into new trading opportunities.

For many exporters it is just as much about customer confidence as it is about cost savings. Following the trade disputes the American buyers are looking for stability and competitive pricing. Moving production offshore allows Indian companies to maintain their existing long term relationships and customers without any interruptions from volatile trading and political environments.

Shifting Production Overseas to Maintain US Market Access

Pearl Global’s diversification strategy highlights the need for a fast response for exporters. The company operates manufacturing bases in India, Bangladesh, Vietnam, Indonesia and Guatemala and supplies to many of the biggest global brands like Ralph Lauren, Primark, Old Navy, Kohl’s and Target.

The company will shift to areas where trade agreements can provide better access in light of US tariffs making India less competitive in the market. “India will continue to grow through new partnerships like the UK FTA and new markets like Japan, Australia, until the US tariff situation is remedied,” Banerjee said.

Another large textile exporter, one of India’s top ten garment manufacturers, also revealed plans to transfer US orders to its African plant. “We will try to shift our US orders to Africa to benefit from better trade terms,” the CEO said.

Adapting to New Tariff Realities

Pearl Global’s diversification strategy underscores the urgency for exporters to adapt quickly. The company operates manufacturing bases in India, Bangladesh, Vietnam, Indonesia, and Guatemala, supplying leading global brands such as Ralph Lauren, Primark, Old Navy, Kohl’s, and Target.

With US tariffs making India less competitive for this market, the company will focus on expanding in regions where trade agreements offer more favorable terms. “India will continue to grow through new partnerships such as the UK FTA and other markets like Japan and Australia until the US tariff issue is resolved,” Banerjee said.

Currently, US revenue from Pearl Global’s Indian operations accounts for 16-18% of total group revenue, while the profit contribution is just 4-5%. This indicates the growing financial importance of overseas facilities for maintaining group performance.

Long-Term Strategy Beyond the US Market

While US trade remains crucial, Indian exporters are also strengthening ties with other global markets. The UK, Japan, and Australia present promising opportunities through free trade agreements. Expanding in these areas will help balance revenue streams and reduce dependence on the US market.

Pearl Global’s ongoing capital expenditure in Bangladesh shows its commitment to building long-term overseas capacity. These investments will ensure that production can be scaled quickly in response to market changes, giving the company flexibility and resilience in an unpredictable trade environment.

Balancing Domestic Growth and Global Shifts

Industry professionals say that, while some, but not all production shifts are taking place, India remains an important base for many exporters. Ongoing domestic manufacturing will continue to serve other global markets and local consumption due to India’s strong textile ecosystem.

But as moving production overseas is now necessary in order to meet the current preferences of trade in the US, brands are repositioning their operational plans during the new way business is conducted globally. Finding the balance of safeguarding their current or future market access and utilizing Indian manufacturing capabilities will determine the future of India’s textile export sector.