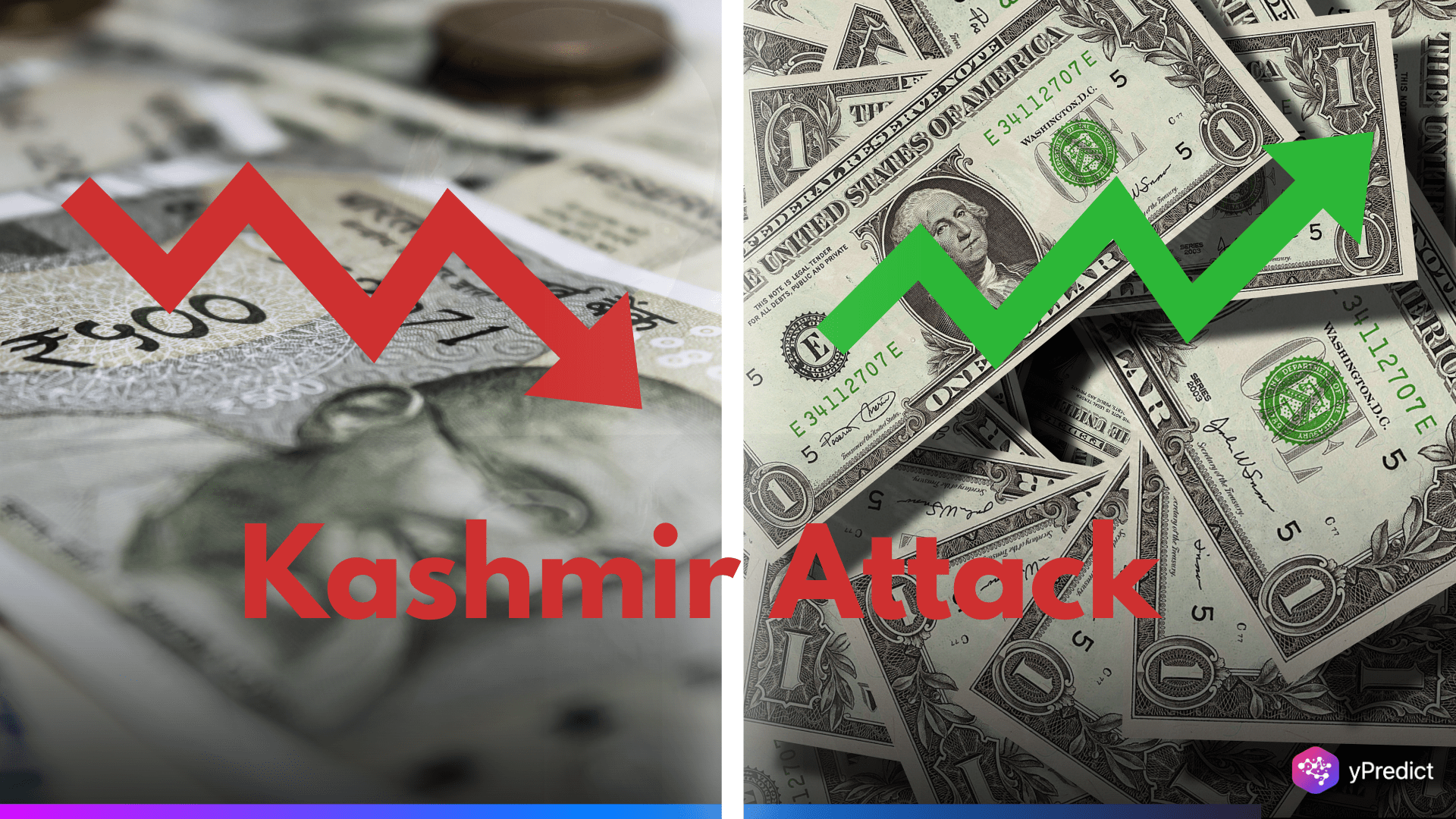

The Indian Rupee (INR) dropped more on Thursday due to new trouble in Kashmir and more people buying US Dollars. The USD/INR rate went up in early European trading. This is because investors were nervous after a deadly attack and were waiting for important US economic news.

Geopolitical Risk and Crude Oil Surge Weigh on INR

The Indian Rupee became weaker after a deadly attack on Tuesday in Jammu and Kashmir, where 28 people were killed. It was the worst attack in the area since 2019. Many countries criticized the violence, and India promised to take action.

The attack made investors worried. When there is violence or problems, people who invest money often move their money to safer places, like the US Dollar. This makes the Rupee lose value.

Strong PMI Data and Tariff Uncertainty Add Complexity

The composite PMI climbed to 60.0, signaling robust private-sector growth. According to HSBC’s Chief India Economist, the temporary pause in US tariffs may have fueled a sharp increase in new export orders.

On the other hand, traders are being careful because the trade fight between the US and China is still not solved. The Trump government might add more taxes on things from China. Since the world economy is already not doing well, this could make investors choose safer options like the US Dollar. This might make the USD/INR rate go up.

US Economic Data in Focus, USD/INR Outlook Stays Cautiously Bearish

Investors are waiting for some important reports from the US, like how many people filed for unemployment, how many big items were ordered, and how the overall economy is doing.

Recent US data was mixed — overall business activity went down to 51.2, but factory work improved a little.

Even though the USD/INR rate went up a bit on Thursday, it’s still weak in the long run. It’s trading below its 100-day average, and another sign (RSI) is also low at 44.35. This shows that the upward movement is not strong, and the rate might go down again.

Conclusion: Short-Term Volatility, Long-Term Uncertainty

While India’s strong domestic data offers a buffer, short-term pressures from geopolitical risk and oil prices could keep USD/INR volatile. Traders will monitor India’s response to the Kashmir attack, oil market trends, and key US data for cues. With the Rupee under pressure and the Dollar in demand, the pair may continue to swing sharply before resuming its broader downtrend.