The USD/JPY forecast is under additional pressure as a result of Moody’s downgrading U.S. credit. The currency pair was once strongly linked to market risk and exchange rate fluctuation. On the other hand, it is currently responding to concerns regarding the legitimacy of the US economy. As a result, traders are reevaluating the dollar’s standing as a safe-haven currency.

Why Is USD/JPY Acting So Differently Now?

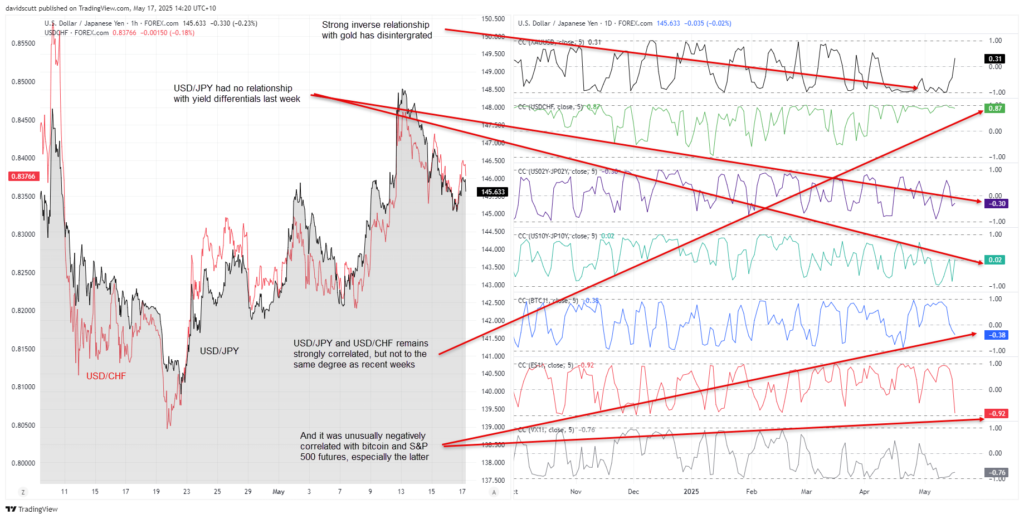

Historically, USD/JPY forecast movements followed U.S.-Japan interest rate spreads and global risk sentiment. As of right now, there is little correlation between the pair and either bond yields or stocks. Even connections to gold, bitcoin, and the VIX have gotten weaker. It’s pointing to a more extensive breakdown in traditional drivers.

On the other hand, the dollar behaves as a risky asset. Furthermore, the euro and pound, two low-risk G10 peers, are trailing the yen. This highlights a problem that lies at the center of the pair’s current movement.

Correlation Breakdown Signals Shift in Trader Sentiment

Following in the footsteps of S&P and Fitch, Moody’s downgraded the U.S. rating to Aa1. It highlights structural debt problems that have been growing for years. Thus, trade deficits, growing debt-to-GDP ratios, and a lack of clarity in financial planning all influenced the decision.

Previous events, like the 2011 S&P cut or Fitch’s 2023 downgrade, showed that the dollar was resilient. However, the response is different this time. As a result, that might drastically alter the USD/JPY forecast for the upcoming weeks.

Charts and CPI Drive USD/JPY Forecast Shift

On the charts, USD/JPY forecast patterns have turned cautious. The candle from last week indicates medium-term weakness with a bearish pin at 148.70. The key downtrend areas are around 144.00 and 141.65, with daily support at 145.00. Particularly if sentiment declines, a break below these could indicate additional losses.

In the meantime, the April CPI report from Japan is crucial. The Bank of Japan is still under pressure to consider a stricter policy. The inflation rate is predicted to rise to 3.4%. If verified, this might strengthen the yen, particularly since the BOJ is focusing on the more sticky core inflation measures.

USD/JPY Forecast Faces More Sentiment Headwinds

Traders are turning to overall macro themes and technical setups since there won’t be any significant U.S. data coming up. A symbolic setback, the U.S. downgrade may have a greater impact on future market activity than anticipated. Moreover, the weak momentum indicators and technical resistance suggest that the pair may still be under downward pressure.

At the same time, the dollar’s fading haven status is increasingly evident. Global investors are treating the greenback more like a high-risk asset. That shift is reshaping strategies, with even moderate inflation in Japan supporting the case for yen strength.

As traders adjust to a changing FX climate, the USD/JPY forecast will likely depend less on data and more on trust. That includes trust in the U.S. economy, its fiscal management, and its global role.

Moody’s Downgrade Alters FX Landscape Fast

The USD/JPY forecast for this week points to a precarious future. However, Moody’s downgrade of the U.S. dollar has made it less attractive as a safe-haven. Still, future Japanese inflation data could boost the value of the yen. Direction may be determined by sentiment in the absence of strong economic indicators.