Mozambique is set to transform its energy future with a $6.4 billion boost from global partners. The World Bank brings in debt and equity funding, political risk insurance, and guarantees for the Mphanda Nkuwa hydropower project. This major project will supply electricity to millions across southern Africa. It also unlocks Mozambique’s massive energy potential. The plan supports sustainable development, expands power access, and attracts private investment into Africa’s energy sector.

Mozambique has long held the capacity to harness hydropower. Yet, regional energy demand outpaced its supply and stalled growth due to limited investment. Now, this funding changes that path. The World Bank’s support strengthens investor confidence and pushes infrastructure goals forward. Mozambique stands ready to rise as a key regional energy hub.

Why Mphanda Nkuwa Is Crucial for Southern Africa

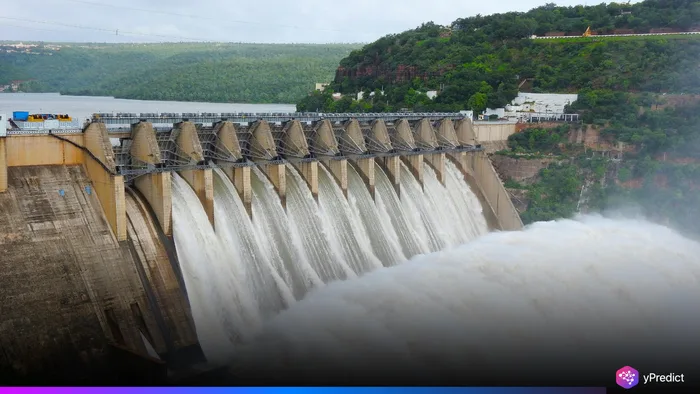

The Mphanda Nkuwa project will be one of the largest energy projects in Africa at 1,500 megawatts of clean energy. The project is on the Zambezi River and will create domestic supply and crossborder electricity sales. The project arises at the time when energy demand is significantly increasing in southern Africa from both industrial opportunities and urban population growth.

Mozambique’s current energy grid cannot support national needs and export demand. With support from the funding and technical assistance from the World Bank, the government is hopeful that the project will remedy a major energy shortfall. The project will also subscribe to the Southern African Power Pool to strengthen national grid stability.

How the World Bank Plans to Make It Happen

A blended financing package from the World Bank consists of equity investment, long-dated loans and political risk insurance. Guarantees will also cover any losses investors may incur resulting from instability or disturbed project. This form of financial structure is designed to mitigate risk to private developers and incentivize additional investment.

As an added incentive to investors, the Multilateral Investment Guarantee Agency (MIGA) will provide political risk insurance, while International Finance Corporation (IFC) could consider direct equity investment. These mechanisms should help attract global energy developers and make the project bankable and appealing to investors.

Unlocking Mozambique’s Renewable Energy Future

Mozambique holds over 12,000 megawatts of untapped hydropower potential. Yet due to lack of financing and political risk, much of it remains unrealized. The Mphanda Nkuwa project will change that by demonstrating how strong international partnerships can enable sustainable energy development.

With climate challenges intensifying, clean power sources are vital. The World Bank funding provides a blueprint for other African nations aiming to harness renewable energy through global collaboration.

What’s Next for Project Development

In 2026, Mozambique government expects to begin civil works with preliminary site works beginning in 2025. The project will be implemented as a public-private partnership which will allow the government to play a managing role, while providing the private sector with speed and efficiency.

Key agreements are already being negotiated on power purchase agreements, transmission lines, and financing terms. The outcome of this project may determine how multilateral lenders treat energy projects in the future.

Global Backing Signals Confidence in Mozambique

While global lenders are increasingly cautious during this environment, Mozambique has attracted attention from several key players, partly due to the progressive, transparent governance that has allowed for quality project negotiations to take place, and partly due to developing some potential funding partnerships with emerging markets.

The fact the World Bank’s commitment is evidence that with the right delivery strategy and risk appetite, the frontier market of Mozambique can also deliver billions of dollars of infrastructure investment.